Energy

NUPENG threatens to resume strike, blocks loading in Dangote Refinery

• Refinery dismisses allegations

• Reaffirms Commitment to Labour Rights, Economic Development

The recently brokered peace by the Ministry of Labour and Employment between the Nigeria Union of Petroleum and Natural Gas Workers (NUPENG) and Dangote Refinery may be short-lived as NUPENG yesterday threatened to resume industrial action.

NUPENG, in an issued statement yesterday accused Dangote Refinery of negating the resolutions reached at the peace meeting.

The Union, in its statement, accused Alhaji Sayyu Aliu Dantata, the founder of MRS Holdings, of instructing all his Truck Drivers who are NUPENG-PTD members for several years to remove the Union Stickers from their trucks yesterday, and subsequently “instructed them to forcefully drive into Dangote Refinery to load.”

The statement further explained that NUPENG officials stopped the trucks entering the Dangote Refinery to load because “their trucks violated Union loading rules and regulations.” At this point, the union alleged that Dantata then invited the Navy to come over “ostensibly to crush the Union officials.”

But responding to the allegation, Dangote Petroleum Refinery, in a statement last night, dismissed recent allegations made by the NUPENG, insisting that claims of anti-labour practices, monopolistic behaviour, and planned fuel price hikes are “entirely unfounded.”

In its official response, Dangote Refinery reiterated its full support for constitutionally protected labour rights, stating that employees are free to affiliate with any recognised trade union. “Assertions that drivers are compelled to waive union rights are categorically false,” the statement said, adding that the dispute involves NUPENG’s Petrol Tanker Drivers (PTD) unit and does not implicate the refinery in any breach of rights,” the statement said.

The NUPENG statement, signed by NUPENG’s President, Akporeha Williams and General Secretary Afolabi Olawale, also accused the Dangote Refinery of working against the agreement.

The statement, titled: “Dangote Empire Negates Resolutions Reached On 9th September 2025,” issued by NUPENG yesterday, read: “This is to alert the general public and the government of the Federal Republic of Nigeria that notwithstanding the resolution reached and signed at the office of the DSS with three Ministers of the Federal Republic of Nigeria and the Deputy Director General of the DSS in attendance on the right of unionisation of the workers, Alhaji Sayyu Aliu Dantata on Wednesday, 10th September, 2025 instructed all his Truck Drivers who are NUPENG-PTD members for several years to remove the Union Stickers from their trucks yesterday.

“Today, Thursday (yesterday), 11th September, 2025, he instructed them to forcefully drive into Dangote Refinery to load and Union officials stopped them from entering the Refinery to load because their trucks violated Union loading rules and regulations.

“Alh Sayyu Aliu Dantata flew over them several times with his helicopter and then called the Navy of the Federal Republic to come over ostensibly to crush the Union officials.

“Our members are waiting for him and his agents to run them over. We call on everyone to let Alh Sayyu Aliu Dantata know that he is not bigger than the Federal Republic of Nigeria and we strongly condemn his arrogant attitude towards official institutions of this great country and blatant lack of respect for the laws of this country. We call on the Federal Government not to allow the Navy and other security agents being paid by the resources of this country to be used with impunity against the laws and people of this country. Security agents should not allow an individual to ride roughshod with impunity even while not observing terms of agreement reached in meetings in which security agents facilitated along with Ministers of the Federal Republic of Nigeria.

“We are by this statement placing all our members on red alert for the resumption of the suspended nationwide industrial action and calling on the Nigeria Labour Congress, Trade Union Congress, all Regional and Global Working people and Civil Society Organisations to rise in support and solidarity against this threat of the Capitalist world.

“His wealth cannot make him above the law”

“We assure the people and the government of the Federal Republic of Nigeria that NUPENG will continue to remain a patriotic, responsible and responsive organisation to this great country.”

According to Dangote Refinery, central to NUPENG’s allegations is the roll-out of over 4,000 CNG-powered bulk trucks, which the union claims could displace existing jobs. Dangote Group firmly refuted this, describing the initiative as a cornerstone of Nigeria’s energy transition strategy.

“The deployment of CNG-powered trucks is a strategic initiative designed to support national energy transition goals, not to displace existing jobs,” the company stated. Each truck will be operated by a six-person team, with drivers receiving salaries significantly above the national minimum wage, plus medical cover, pensions, housing allowances, and long-term access to housing loans. The company aims to have 10,000 such trucks in operation by year-end, potentially creating over 60,000 direct jobs.

Responding to accusations of monopolistic behaviour, Dangote Refinery emphasised its compliance with Nigeria’s deregulated oil sector under the supervision of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA).

The company highlighted that over 30 refinery licences have been issued to private players, with active developments by BUA, Aradel, Walter Smith, and the Edo Refinery. “While we are major industry player, our presence has revitalised the downstream sector, reopened previously dormant petrol stations and restored investor confidence,” the management said.

The statement also drew parallels with the company’s influence in the cement industry, noting that Dangote’s entry helped eliminate Nigeria’s reliance on imports and spurred the rise of other local producers.

Dangote Refinery strongly denied any plans to increase fuel prices. On the contrary, the company claims its operations have stabilised fuel availability and driven down costs. Diesel prices, for instance, have dropped by over 30% in the past year, and petrol prices in Nigeria are now reportedly lower than in oil-rich nations like Saudi Arabia and 40% cheaper than neighbouring West African countries.

The company also pointed to its N720 billion investment in CNG infrastructure as evidence of its commitment to reducing logistics costs and improving nationwide fuel distribution.

Dangote stated it maintains a cordial and cooperative relationship with all recognised trade unions, including NUPENG. It rejected accusations of walking out on recent conciliation efforts, stating that the union had not formally communicated any grievances before going public.

“We acknowledge and appreciate the intervention of the Federal Government, particularly the Ministry of Labour and Employment, and remain fully supportive of ongoing efforts to achieve a lasting resolution. We hold both the Minister, Dr Mohammed Dingyadi (Katuka Sokoto) and Mrs. Nkiruka Onyejeocha, in the highest regards, and reject any suggestion that we have acted in a manner that would undermine their involvement. The Hon. Minister granted Mallam Sayyu Dantata the permit to enable him attend to his medication,” the company said, expressing appreciation for the roles played by the Ministry of Labour and Employment and key ministers involved in mediating the dispute.

With over 570,000 direct and indirect jobs created, including through road, power, and water infrastructure projects, Dangote Refinery has positioned itself as a centre for skills development and technology transfer in Nigeria.

Reiterating its commitment to responsible business, Dangote Group concluded by dismissing the monopoly allegations as “recycled falsehoods”, urging other private sector players to follow its lead in investing in Nigeria’s economic future.

“At Dangote, we have chosen to invest boldly in Nigeria’s future and we will continue to do so. It is time others follow suit.”

Energy

‘Blame regulators for contract delays despite President Tinubu’s order’, says PETAN

The Chairman, Petroleum Technology Association of Nigeria (PETAN), Wole Ogunsanya, has blamed petroleum industry regulators for persistent delays in oil and gas contracting processes, despite a presidential directive requiring tenders to be concluded within six months. Ogunsanya disclosed this during his presentation at the opening ceremony of the Nigeria International Energy Summit (NIES) 2026 in Abuja, yesterday. The Presidential directive is aimed at accelerating project execution across the energy sector.

Recall that President Tinubu in March 2024, issued Executive Order (OE) 42 mandating reduction of petroleum sector contracting costs and timelines, being part of a wider set of oil and gas reforms signed by the administration.

“We are not concluding contract processes in six months as directed and reports sent to the Presidency often fail to reflect the realities faced by industry players,” the PETAN boss said.

Ogunsanya disclosed that his Association is currently monitoring ongoing tenders, emphasising that several projects scheduled to commence in 2026 and 2027 remain stalled due to prolonged contracting cycles.

He noted that execution gaps persist despite a significant increase in contracting activities involving expressions of interest, tenders, pre-qualifications, and technical and commercial evaluations since the fourth quarter of 2024. He also identified prolonged internal approvals, delayed Final Investment Decisions (FIDs), slow commercial negotiations, extended regulatory and compliance procedures, and funding and financial close challenges as major bottlenecks undermining project delivery.

According to him, a study conducted by PETAN revealed that the current rate of contract awards falls significantly short of the Presidential benchmark of completing tenders within six months, with most contracts structured for five years and a possible two-year renewal.

Ogunsanya therefore called on the Presidency to give closer monitoring of the contracting process to ensure that awards and project execution align with presidential timelines, warning that continued delays could weaken investor confidence and slow sector growth.

Energy

Fed govt’s policies secured over $8b FIDs in oil, gas industry, says President Tinubu

• Domestic gas supply exceeded 2 billion cubic feet daily

• NNPC to expand Escravos Lagos Pipeline Line

President Bola Tinubu has said his administration has strengthened the oil and gas sector to secure a Final Investment Decisions (FIDs) surpassing $8 billion in offshore gas developments from global energy firms.

He said the torrent of direct investments into the sector revived strongly because of regulatory certainty and fiscal reforms.

President Tinubu disclosed this yesterday while officially declaring open the 9th edition of the Nigeria International Energy Summit (NIES) at the Banquet Hall, State House, in Abuja. He was represented by Vice President, Kashim Shettima.

President Tinubu said: “The sector secured final investment decisions exceeding $8 billion, including major offshore gas developments involving global energy companies. The outpouring of direct investment into the oil and gas sector rebounded strongly, driven by regulatory certainty, fiscal reforms and improved operational guidelines and conditions.”

He said domestic gas supply exceeded two billion cubic feet per day for the first time, strengthening power generation, industrial utilisation and energy access. Export volumes, according to him, increased alongside sustained expansion of gas processing and transportation infrastructure, reinforcing Nigeria’s role in regional and global gas markets.

The President reminded the stakeholders that on his assumption of office in 2023, the sector was only rich in potential, but weighed down by inefficiencies, uncertainty and underinvestment.

His words: “When this administration assumed the mantle of leadership in May 2023, we inherited an energy sector rich in potential, yet constrained by inefficiencies, uncertainty, and prolonged underinvestment. We set to work without panicking, guided by the clear understanding that energy cannot be treated simply as an economic commodity if stability is our goal. Energy is a catalyst for national security, industrial growth, social inclusion, and regional cooperation.”

Tinubu said under his administration, Nigeria’s upstream activity recorded a historic rebound, recounts growth from eight weeks in 2021 to 69 weeks by late 2025, reflecting renewed exploration and building momentum

The Federal Government, he said, has also introduced a broad executive order on oil and gas investment enabling to unlock up to $10 billion in capital inflows, streamline project approvals, reduce bureaucratic delays and position Nigeria as a prepared investment destination.

He recalled that in 2025, the administration introduced the Upstream Petroleum Operations Cost Efficiency Incentives Order, providing tax credits of up to 20 per cent to promote cost efficiency, enhanced competitiveness, and deepened Nigerian participation.

Tinubu also noted that as a direct result of the reforms the government has introduced, Nigeria’s average crude oil production improved to approximately 1.6 million barrels per day.

The administration, he said, consolidated its role as a live wire of sector reform and strengthened regulatory institutions to ensure clarity of goals, transparency and investor competitiveness.

He added that the country introduced fully digital, transparent, and competitive licensing rounds to the upstream sector, widely regarded as among the most credible bidding processes in our history.

On the 2025 bid round, he said: “In furtherance of this objective, we approved the commencement of the 2025 licensing round, creating new investment windows and enabling additional crude oil and gas production capacity.”

He said Nigeria’s refining landscape entered a new era with the commencement of local operations and the Dangote Petroleum Refinery, significantly enhancing domestic supply of refined petroleum products.

The President said modular and indigenous refineries advanced under supportive regulatory frameworks, diversifying national refining capacity. On the Nigerian National Petroleum Company Limited NNPCL refineries, he said “Rehabilitation of state-owned refineries also gained renewed momentum, with operational stability and efficiency remaining a primary focus.”

He added that the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) recorded strong and consistent revenue performance, surpassing annual targets and fiscal sustainability.

In similar vein, the Minister of State for Petroleum Resources (Oil), Senator Heineken Lokpobiri said the renewed confidence has culminated in the huge FIDs inflows into the sector.

He said: “International confidence has also returned: Shell’s $5 billion Bonga North project, and TotalEnergies’ $550 million Ubeta project marks Nigeria’s first major FIDs in over a decade. This was followed by Shell’s $2 billion HI project and the $1.8m cumulative spent by Chevron in their Panther project.

“Only recently, the global CEO of Shell announced their commitment to taking a $20 billion FID, with several other FID lined up to be announced in this year and in the coming year.

“In 2025 alone, 28 new field development plans worth $18.2 billion were signed, with potentials of 1.4 billion barrels of oil daily.

Between 2024 and 2025, of the seven major FIDs announced across Africa, four were in Nigeria. This did not happen by accident, it is the result of steady work, policy clarity, and better governance. These are not rhetorics but proof that Nigeria is once again a magnet for serious business.”

In his remarks, the Nigerian National Petroleum Company Limited (NNPCL) Group Chief Executive (Officer) Bashir Ojulari, an engineer, revealed that the firm has planned to expand the Escravos Lagos Pipeline Line (ESPL) this year.

Hear him: “Our recent achievements reflect this momentum. The presentation of the NNPC Gas Master Plan last week and the remarkable progress of our strategic gas infrastructure projects, the OB3 and the AKK pipeline and we are moving forward this year to also expand the ELPS pipeline, and the regional pipelines to their projects signal a new era of mining discipline, infrastructure development, and long-term commitments. These projects are more than a pipeline.”

NNPCL, according to him, is nurturing a new generation of professionals grounded in accountability, performance excellence and national service.

He said the strategic shifts, under the leadership of President Tinubu, is positioning Nigeria in a global competitive investment destination, from fiscal stability to policy liberalisation and security improvement.

Energy

Why stable power supply may remain elusive

• Over 60% of power plants unavailable for transmission in Q3 2025, says report

• Report exposes Discos culpability

• NERC may sanction erring entities

The state of electricity supply in the country has become a source of concern for residents. After enjoying a relative supply for some parts of last year, especially in the second quarter, drawing applause from consumers, the euphoria that greeted this has gradually becoming worrisome.

These concerns were more pronounced during the last yuletide, when several homes were left in the dark. The situation, electricity Distribution Companies (DisCos) often explain, results from national grid collapses, low power generation, gas supply shortages, or maintenance work by the Transmission Company of Nigeria (TCN). These issues, alongside infrastructure decay and vandalism, invariably leads to load shedding and intermittent supply.

Top officials of some Discos spoken to who pleaded for anonymity attributed power failures to a mix of upstream generation deficits, national grid instability and localised infrastructure challenges.

For a long time, there has been several horse-trading associated across the value chain over erratic power supply. For instance, it is common for DisCos often cite “system-wide disturbances” or “grid collapses” from the National Control Centre (NCC) as the reason for total outages across their franchise areas. Besides, many outages are blamed on “gas limitations” at thermal power plants and a general drop in power generation. This is because when generation drops, the energy allocated to DisCos decreases, forcing them to implement load shedding.

In situations like this, most hide under the guise of the feeder banding system. Under this framework, priority is given to “Band A” feeders, which are mandated to receive 20+ hours of supply thereby often leaving lower bands with significant outages when total available power is low.

Yet, is the technical faults and maintenance of equipment, equipment vandalism like destruction of transformers and theft of cables; planned maintenance, like upgrading or repairing transmission lines, are also factor readily given as excuses by service providers.

After enjoying relative stability in national grid in 2025, the facility experienced a first major collapse at the weekend caused by the simultaneous tripping of multiple 330kV transmission lines.

With this incident coming early in the year, stakeholders are worried that it may not be a good omen for the sector notwithstanding the several assurances by government. In 2024, 12 grid collapses were recorded; 12 in 2025 and one already recorded this year.

More worrisome is that the epileptic power supply has remained irrespective of the fiscal appropriation to the sector under the President Bola Tinubu administration.

A cursory look at these allocation indicate that in the last three years, there has been a consistent increase in fiscal allocation to the Ministry of Power aimed at resolving the underlying issues that have consistently impeded growth in the sector, including the consistent grid collapses each year.

A breakdown of the figures the three years showed that the power ministry got a cumulative allocation of N239.5 billion in 2023; N344.097 billion in 2024; N2.1 trillion in the 2025 budget, a clear indication of the priority placed on the sector by the current administration.

A further breakdown of the figures show that the power sector recovery programme received N810 billion from the budget; special intervention project got N269.74 billion, while the presidential power initiative (PPI) transmission project received N150 billion, all in an attempt to tackle the enormous challenges in the nation’s power sector from specific and targeted approach.

The Minister of Power, Adebayo Adelabu, assured that the ministry has set the agenda for Nigeria’s power sector in the year 2026, suggesting that the country has done enough to stabilise its grid in the previous year.

But these challenges appear unresolved despite huge budgetary allocations to the power sector. Giving more insight into what may be the cause of the deep-seated challenges confronting the country’s electricity supply is a recent report by the Nigerian Electricity Regulatory Commission (NERC) for the third quarter of 2025. The report, released recently, indicated that over 60 per cent of power plants installed generation capacity in the country remained unavailable for transmission to the national grid in the third quarter of 2025.

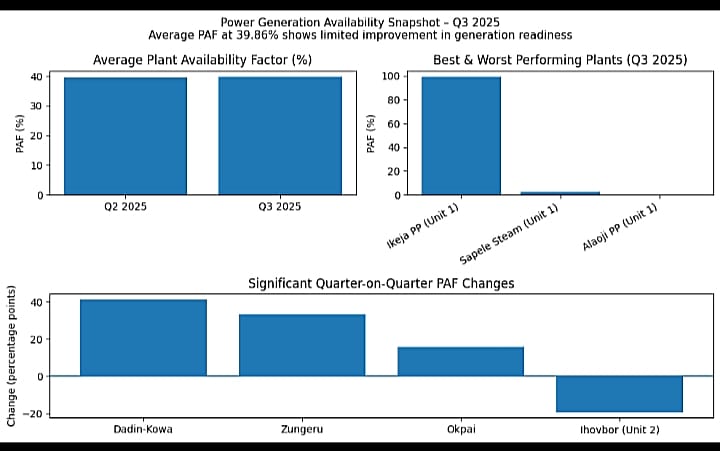

According to the NERC report, the average Plant Availability Factor (PAF) of all 28 grid-connected power plants stood at 39.86 per cent, meaning that 60.14 per cent of installed capacity could not be dispatched to the national grid at any point during the quarter. The figure represents only a 0.26 percentage-point increase from the 39.60 per cent recorded in Q2 2025, highlighting how limited progress has been in improving the operational readiness of generation assets.

“In 2025/Q3, the average plant availability factor for all grid-connected plants was 39.86 per cent, that is, at any point in time during the quarter, 60.14 per cent of the installed capacity across the 28 grid-connected power plants was not available for dispatch onto the grid,” the report read.

The PAF measures the ratio of a power plant’s declared available capacity to its manufacturer-rated installed capacity and is widely regarded by regulators as a key indicator of the health of the upstream segment of the Nigerian Electricity Supply Industry (NESI).

It further noted that while 11 power plants recorded availability above 50 per cent, Ikeja Power Plant (Unit 1) emerged as the best-performing asset, posting a PAF of 99.24 per cent during the quarter. At the lower end, Sapele Steam Plant (Unit 1) recorded a PAF of just 2.66 per cent, while Alaoji Power Plant (Unit 1) failed to dispatch any electricity at all throughout the quarter.

Significantly quarter-on-quarter improvements were recorded at Dadin-Kowa (+41.32pp), Zungeru (+33.29pp) and Okpai (+15.95pp), reflecting gains from improved hydrology and reduced outages.

However, availability declined sharply at Ihovbor (Unit 2), which fell by 19.21 percentage points to 78.16 per cent, down from 97.38 per cent in Q2. Other plants that recorded notable drops included Geregu (Unit 1), Ibom Power, and Geregu (Unit 2).

“Overall, 11 power plants had availability factors above 50 per cent, with Ikeja_1 power plant recording the highest availability factor at 99.24 per cent. On the other end of the spectrum, Sapele Steam_1 recorded a PAF of 2.66 per cent in 2025/Q3. Alaoji_1 power plant was not available to dispatch any energy onto the grid throughout the quarter.

“Significant increases in PAF were recorded in Dadin-Kowa_1 (+41.32pp), Zungeru_1 (+33.29pp), and Okpai_1 (+15.95pp) power plants across the two quarters. Conversely, the PAF of Ihovbor_2 decreased significantly by 19.21pp during the quarter (78.16 per cent in 2025/Q3 compared to 97.38 per cent in 2025/Q2). Reductions in PAF were also recorded in Geregu_1 (- 12.79pp), Ibom power_1 (-10.34pp), and Geregu_2 (-8.41pp) power plants,” the NERC report said.

The commission attributed the fluctuations in plant availability to mechanical outages, feedstock constraints, hydrological conditions and operational limitations, factors that have continued to undermine Nigeria’s generation capacity for over a decade.

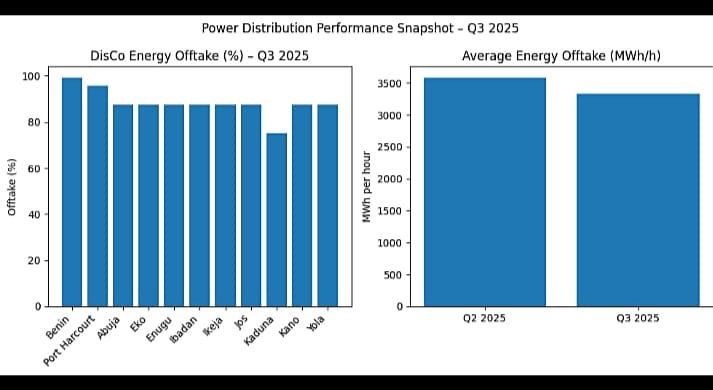

Beyond generation challenges, the report also highlighted weak energy offtake by electricity Discos, raising concerns over revenue recovery and market discipline. Under the Partial Activation of Contract regime, which came into force in July 2022, DisCos are required to off-take and pay for their Partially Contracted Capacity on a take-or-pay basis, even if they fail to utilise the power.

In Q3 2025, average energy offtake by DisCos fell to 3,328.33 megawatt-hours per hour, representing a 7.10 per cent decline from 3,582.62MWh/h recorded in the preceding quarter.

This decline occurred despite the fact that available contracted capacity dropped by only 2.43 per cent, suggesting that generation and transmission availability were sufficient to sustain previous offtake levels.

Overall, cumulative DisCo energy offtake performance during the quarter stood at 87.39 per cent, down from 91.78 per cent in Q2, a 4.39 percentage-point decline.

“All DisCos except Jos recorded a decline in their energy offtake performance during the quarter,” the report noted.

The commission attributed the reduced offtake to a combination of infrastructure weaknesses, seasonal demand changes and commercial considerations.

It noted that frequent network outages during the rainy season, driven by fragile distribution infrastructure, limited the ability of DisCos to evacuate power to customers.

In addition, cooler weather conditions reduced domestic electricity demand, while some DisCos deliberately constrained supply to loss-prone feeders to minimise financial exposure.

Under the Performance Monitoring Framework Orders issued in July 2024, DisCos are required to off-take at least 95 per cent of their available PCC or face regulatory sanctions.

However, in Q3 2025, only Benin and Port Harcourt DisCos met the threshold, with offtake levels of 99.20 per cent and 95.65 per cent, respectively.

The remaining nine DisCos, Abuja, Eko, Enugu, Ibadan, Ikeja, Jos, Kaduna, Kano and Yola, fell short, with Kaduna DisCo recording the lowest performance at 75.23 per cent.

“The Commission has commenced the implementation of appropriate sanctions against defaulting DisCos,” the report stated.

The figures reflect the persistent mismatch between installed capacity, available generation, and effective electricity delivery, a challenge that continues to frustrate households and businesses.

Despite Nigeria’s installed generation capacity exceeding 13,000 megawatts, average operational availability and weak offtake mean that actual electricity delivered to consumers remains far below demand, reinforcing dependence on self-generation and driving up energy costs.

-

Art & Life9 years ago

Art & Life9 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Business9 years ago

Business9 years agoThe 9 worst mistakes you can ever make at work

-

Art & Life9 years ago

Art & Life9 years agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 years ago

Entertainment9 years agoThe old and New Edition cast comes together to perform

-

Sports9 years ago

Sports9 years agoPhillies’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment9 years ago

Entertainment9 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Entertainment9 years ago

Entertainment9 years agoDisney’s live-action Aladdin finally finds its stars