Economy

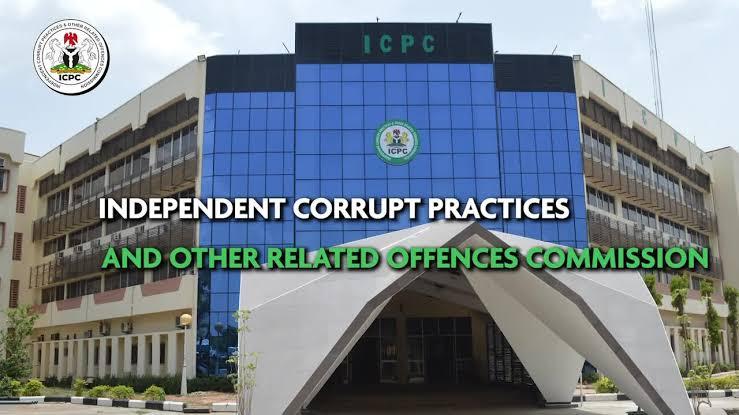

ICPC: Tax evasion, cybercrime, others fuel Africa’s $50b yearly financial leak

By Grace Edet

Africa is losing more than $50 billion every year to illicit financial flows (IFFs), a drain that is stifling development, eroding public revenues and undermining the continent’s long-term economic goals, the Independent Corrupt Practices and Other Related Offences Commission (ICPC) has warned.

ICPC Chairman, Dr. Musa Aliyu, gave the warning on Wednesday at the RealNews Magazine 13th Anniversary Lecture in Lagos, where he described the persistent capital flight as “one of the most devastating drains on Africa’s development capacity.”

According to him, the lost funds—diverted through tax evasion, corruption, illegal mining, wildlife trafficking, profit shifting, and cyber-enabled crime, could have financed schools, hospitals, roads and other critical public infrastructure.

He said: “Illicit financial flows, whether through tax evasion, corruption or cybercrime, have become a silent crisis that threatens Africa’s sovereignty and the future of its youth.”

Aliyu disclosed that ICPC investigations have exposed cases where multinational corporations manipulated trade figures and inflated operating costs to evade taxes. In one instance, he said, a major firm exaggerated its expenses to shrink its taxable profit, adding: “The amount lost would have been enough to construct a world-class hospital in Nigeria.”

He described trade mispricing, profit shifting and tax evasion as “some of the biggest contributors to financial leakages,” noting that corrupt officials also worsened the crisis by diverting public funds through multiple bank accounts, often with the collusion of financial institutions.

The ICPC chairman warned that Africa’s rapid digital transition, where mobile-money usage has surpassed 50 percent in several countries, has exposed the region to an unprecedented wave of cyber-enabled crimes.

He said: “Cyber criminals are becoming more sophisticated. Ransomware attacks, cryptocurrency-based laundering and mobile-money fraud are growing threats.”

Aliyu added that criminal networks often possess more advanced tools and resources than enforcement agencies, making it increasingly difficult to track stolen funds once they leave African jurisdictions. He also highlighted ongoing ICPC investigations into ghost-worker syndicates manipulating payroll systems to divert salaries.

To curb the losses, he urged the National Assembly to speed up the passage of the Whistleblower Protection Bill, stressing that citizens cannot provide critical intelligence “if they are not protected.”

He also called for stronger cyber laws, improved digital infrastructure, dedicated training for enforcement agencies, and full implementation of the Malabo Convention on Cybersecurity and Data Protection.

He emphasised the need for African countries to adopt a coordinated approach to asset recovery and demand the return of looted funds and cultural artefacts held abroad.

“We must secure our financial systems and protect our digital space. Only then can Africa realise its full potential,” he said.

Chairperson of the event and former Chief Judge of Lagos State, Justice Ayotunde Phillips, also urged African governments and the private sector to prioritise the continent’s development and cybersecurity agenda.

She warned that growing vulnerabilities in digital transactions were worsening capital flight from the continent, stressing: “We should not joke with this; progress requires commitment from both government and private actors.”

Phillips said Africa had the capacity to strengthen its economic and security frameworks, but success would depend on consistency and serious implementation of agreed plans.

Economy

Davos: Nigeria reframes food security as macro-stability strategy

• says ‘Back to the Farm’ initiative will tame inflation, cut FX on imports

Nigeria has unveiled a sweeping macro-strategy that places food security at the heart of national stability, inflation control, and regional cohesion, with Vice President Kashim Shettima declaring that the country no longer views the issue through a narrow agricultural lens.

Speaking at a high-level panel, “When Food Becomes Security,” at the Congress Centre during the 56th Annual Meeting of the World Economic Forum in Davos, Vice President Shettima said the Federal Government has begun a multi-dimensional agricultural drive, designed to insulate Nigeria from global shocks while restoring productivity across its food-basket regions.

According to a statement issued by Senior Special Assistant to the President on Media and Communications Office of the Vice President Stanley Nkwocha, Shettima said, “In Nigeria, we don’t look at food security purely as an agricultural issue. It is a macroeconomic, security, and governance issue. Our focus is to use food security as a pillar for national security, regional cohesion, and stability.”

He explained that Nigeria’s food security strategy rests on three pillars: increased food production, environmental sustainability, and deeper regional integration within West Africa.

According to him, changing global trends and supply-chain disruptions have compelled the country to rebuild resilient food systems tailored to diverse ecological zones.

“Nigeria is a very large country, and there is an incestuous relationship between economy and ecology. In the Sahelian North, we are dealing with desertification, deforestation, and drought. In the riverine South and parts of the North Central, flooding is our major challenge,” he noted.

To confront these realities, the Vice President said the government is promoting drought-resistant, flood-tolerant and early-maturing varieties of staples such as rice, sorghum and millet, while redesigning food systems in flood-prone southern regions to withstand climate shocks.

Security, he added, remains a binding constraint because many conflict-affected areas double as major food-producing zones.

“Most of the food baskets of our nation are security-challenged. That is why we are creating food security corridors and strengthening community-based security engagements so farmers can return safely to their land,” he said.

Shettima disclosed the launch of the Back to the Farm Initiative, aimed at resettling displaced farmers with inputs, insurance, and access to capital to restart production.

On macroeconomic vulnerabilities, he identified import dependence and foreign-exchange volatility as key drivers of food inflation.

“We largely import wheat, sugar, and dairy products, and this has a direct impact on inflation. Our strategy is to accelerate local production and promote substitutes such as sorghum, millet, and cassava flour to correct these structural imbalances,” he said.

Positioning agriculture as a frontline response to economic and security threats, the Vice President said Nigeria’s approach aligns food security with national stability, inflation control, and regional cooperation.

He further stated that the country, dubbed “the African giant”, has “woken up from its slumber” under President Bola Ahmed Tinubu, and that within 12 months the government would make “it possible for smallholders and fishers to become investable at scale.”

Highlighting continental dynamics, Shettima said intra-African trade has “almost become a necessity,” adding that “there have been some alignments.”

He urged African leaders to intensify cooperation under the African Continental Free Trade Area, expressing optimism that ongoing Renewed Hope Agenda reforms would soon translate into climate adaptation moving from pilot to reality, and a boom in intra-African trade far beyond 10.7 per cent.

Economy

Tax Reforms: Encourage compliance, not penalties, CPPE urges govt.

- Calls for strategic implementation

The Centre for the Promotion of Private Enterprise (CPPE), yesterday said tax reform is essential for Nigeria’s fiscal sustainability, but implementation strategy will ultimately determine the success or failure. The economic think-tank group noted that a phased, pragmatic, and socially sensitive approach anchored on trust, economic realities and political timing offers the most credible pathway to sustainable revenue growth, expanded compliance and long-term legitimacy.

Besides, the CPPE advocates that a strategic implementation framework anchored on revenue efficiency rather than blanket enforcement should drive the process as empirical evidence consistently show that a small proportion of taxpayers account for the bulk of tax revenue.

The body noted that about 20 per cent of businesses generate close to 90 per cent of tax receipts, while about 20 per cent of taxpayers contribute over 80 per cent of personal income tax. It therefore submitted that concentrating enforcement on large corporations, established SMEs, and high-net-worth individuals will deliver substantial revenue gains without destabilising livelihoods or deepening social resistance.

The Chief Executive Officer, CPPE, Dr. Muda Yusuf, in a statement made available to The Trust News, noted that tax reform is not a one-off exercise; but rather a dynamic process that must evolve with implementation feedback, economic conditions and social realities.

The CPPE boss advised that in the short to medium term, tax authorities should prioritise the formal sector, where compliance capacity already exists, adding that the informal sector should be integrated gradually through incentives, sustained tax education, simplified compliance tools, and digital onboarding support.

“Shifting the emphasis from penalties to compliance-building will produce more durable outcomes. The objective should be to grow the tax net organically, not force it prematurely. With 2026 shaping up as a pre-election year, political and social caution is imperative. Aggressive, broad-based enforcement risks social discontent, political backlash, and potential reform reversal. Stability, trust-building, and reform credibility must take precedence over short-term enforcement optics,” Dr. Yusuf cautioned.

According to him, Nigeria’s ongoing tax reform ranks among the most ambitious fiscal restructuring efforts in recent decades. Conceptually, he argued, it is a sound and progressive framework aimed at strengthening revenue mobilisation, improving equity, simplifying the tax system and aligning fiscal policy with economic diversification and growth objectives.

He however expressed concerns that good policy design does not guarantee good outcomes. He stressed that the ultimate success or failure of the country’s tax reform will depend far less on its legislative provisions and far more on how it is implemented because without careful sequencing, political sensitivity, and economic realism, even well-intentioned reforms can trigger resistance, disrupt livelihoods, and further erode public trust.

“Nigeria’s current reform is unfolding under unusually delicate circumstances. The economy is still absorbing the aftershocks of elevated inflation, weakened purchasing power, and the adjustment costs of fuel subsidy removal and foreign exchange reforms. Many households and businesses are experiencing reform fatigue. Compounding this is the approach of a politically sensitive pre-election period.

“In this context, expecting full and simultaneous compliance across all sectors of the economy is unrealistic. A rigid, enforcement-heavy approach risks undermining reform credibility before its benefits have time to materialise,” Dr. Yusuf said.

According to the CPPE boss, despite public controversy, the tax reform framework contains several commendable and pro-welfare provisions. He listed these to include but not limited: Low-income earners are exempted from personal income tax, while VAT relief on basic goods and essential services—including education, healthcare, agriculture, and cultural activities—provides important social protection. Small businesses benefit from relief from company income tax and VAT obligations, easing compliance pressures on vulnerable enterprises.

On the growth side, Dr. Yusuf said the targeted incentives for priority and job-creating sectors strengthen alignment between tax policy and Nigeria’s diversification agenda.

“The rationalisation of multiple taxes, repeal of obsolete laws, and improved coherence of the tax system also respond to long-standing private-sector demands and could enhance predictability and investor confidence if properly implemented,” he said.

The CPPE argued that any serious discussion of tax reform in Nigeria must confront the scale of the informal economy. The group argued that with an estimated 40 million micro, small, and nano enterprises—over 80 per cent operating informally, the informal sector is not peripheral; it is central to employment, income generation, and economic resilience.

“Most informal operators lack structured record-keeping systems and have limited understanding of tax concepts such as Tax Filing obligations, Company Income Tax [CIT], Value Added Tax [VAT], Personal Income Tax [PIT], Withholding Tax etc.. Businesses are largely cash-based, operate on thin margins, and often lack the literacy and digital capacity required for compliance. They also lack the capacity to digest the technical and somewhat complex issues around taxation.

“Yet the new tax framework introduces mandatory filing requirements, defined record-keeping standards, penalties for non-compliance, and presumptive taxation where records are inadequate. Without careful sequencing, these provisions risk criminalising informality rather than encouraging gradual and voluntary formalisation,” the CPPE said.

He however regretted that public resistance to the reform is not merely a communication failure but it is rooted in lived experience. This, he explained is because for many Nigerians, past reforms have translated into higher living costs and declining welfare, with little evidence that sacrifices result in improved public services.

Besides, Dr. Yusuf noted that several specific provisions and regulations have intensified concerns among small businesses and households. For instance, he said the mandatory reporting of quarterly bank transactions of ₦25 million and above to the tax authority has raised anxiety among SMEs that handle pass-through or custodial funds that do not constitute income. High-turnover, low-margin businesses risk undue scrutiny and costly compliance disputes.

Also is the the proposed increase in capital gains tax from 10 percent to 30 percent-despite assurances around thresholds- has unsettled investors in the stock market and real estate at a time when confidence remains fragile. Similarly, the ₦500,000 annual rent relief cap is misaligned with prevailing urban housing costs and risks further squeezing middle-class disposable income. Concerns are further heightened by the wide enforcement powers granted to tax authorities and the severity of penalties and sanctions embedded in the tax laws.

“A weak social contract continues to undermine confidence that additional tax revenues will be transparently and efficiently deployed. With businesses and households still recovering from recent macroeconomic shocks, tolerance for new compliance demands is understandably low. In this environment, trust is as critical as technical design,” he said.

Economy

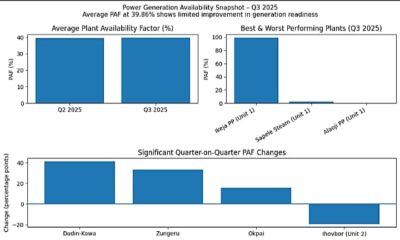

Expert charts path for effective power reforms

As the nation continue to grapple with electricity challenges, irrespective of the reforms being implemented , stakeholders and economists in the country have said the Power sector reform in the country remains a long-term and incremental process rather than a quick fix.

They based their submission on the sector’s complexity, political economy constraints, and institutional weaknesses, which would make the progress gradual rather than instant, warning that without decisive action to address structural inefficiencies, improve governance, and ensure fiscal discipline, the current trajectory will remain unsustainable.

An economist and Chief Executive, Center for the promotion of Private Enterprise (CPPE), Dr. Muda Yusuf, noted that despite multiple reform efforts over the years, the sector continues to face deep structural, financial, and governance challenges.

These challenges, he said, are multi-dimensional, spanning political economy constraints, tariff distortions, weak investor capacity, transmission bottlenecks, and a persistent liquidity crisis across the value chain.

He argued that the inability to implement a fully cost-reflective tariff regime—largely due to social and political sensitivities following recent macroeconomic reforms—has entrenched subsidy dependence and widened the sector’s financing gap, thereby making government intervention to become unavoidable in the short term to prevent system collapse and sustain electricity.

He listed recent macroeconomic reforms, including foreign exchange unification and fuel subsidy removal, to have further complicated the reform environment by heightening cost-of-living pressures and intensifying resistance to tariff adjustments in the power sector.

“However, without cost-reflective pricing, the sector is unable to generate sufficient liquidity to sustain operations or attract new investment. The resulting subsidy burden has forced government to repeatedly intervene financially, effectively transferring inefficiencies and revenue shortfalls onto the public balance sheet,” the CPPE boss said.

Yusuf made it known that the current trajectory, characterised by rising sector debt currently at about ₦4 trillion, is fiscally unsustainable without deeper structural corrections, improved transparency, and gradual but credible reform implementation.

Giving an analysis of the sector, yesterday, the CPPE helmsman advocated for a balanced approach-one that combines short-term government support with medium- to long-term structural reform. This, he noted, is essential to building a financially viable, reliable, and inclusive power sector that can support Nigeria’s economic growth and development.

According to Yusuf, the current financing model for the sector is not sustainable. He’s arguement is based on the sector’s liabilities which have risen to nearly ₦4 trillion and continue to grow.

He therefore warned that there is an urgent need to ensure that all outstanding claims are properly verified; subjected to rigorous audit and managed transparently and credibly.

“Nigeria’s experience with fuel subsidy regimes demonstrates the vulnerability of subsidy systems to abuse and malpractice. Strong oversight and accountability mechanisms are therefore essential to prevent similar outcomes in the power sector,” Yusuf warned.

He noted that one of the major problems that has. Continued to weigh on the finances of the sector is the lack of a cost reflective tariff regime.

To address this, Yusuf, a policy analyst, admonished for the implementation of a phased and predictable transition toward cost-reflective pricing, with targeted social protection for vulnerable consumers.

This, he said, should be backed by a strong governance and accountability regime which will be targeted at improving transparency in subsidy management, debt verification, and financial settlements.

Importantly, he further added, is the urgency in addressing the distribution sector weaknesses. This will be by way of enforcing performance benchmarks for Discos, including recapitalisation, technical upgrades, and loss reduction.

The CPPE boss also canvassed for a reform in transmission management by exploring alternative management or concession models for TCN to improve efficiency and investment.

“It is important to support decentralization and renewables; encourage state-level initiatives, independent power projects, and renewable energy adoption to reduce pressure on the national grid. Also, we need to limit fiscal exposure as government financial support should be clearly time-bound and linked to measurable reform milestones,” Yusuf argued.

-

Art & Life9 years ago

Art & Life9 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Business9 years ago

Business9 years agoThe 9 worst mistakes you can ever make at work

-

Art & Life9 years ago

Art & Life9 years agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 years ago

Entertainment9 years agoThe old and New Edition cast comes together to perform

-

Sports9 years ago

Sports9 years agoPhillies’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment9 years ago

Entertainment9 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Entertainment9 years ago

Entertainment9 years agoDisney’s live-action Aladdin finally finds its stars