Business

FAAC: FG, states, LGAs shared N2trn in July, VAT revenue increased by N9bn

The Federation Account Allocation Committee (FAAC) says it shared N2 trillion with the three tiers of government in July 2025.

According to a statement on Friday by Muhammed Manga, director of information and public relations, ministry of finance, the amount was disclosed at the August 2025 meeting.

The meeting was chaired by Wale Edun, minister of finance and coordinating minister of the economy.

The committee said the gross total revenue was N3.83 trillion, out of which N2 trillion was shared among the three tiers.

From the total amount, which includes statutory revenue, value-added tax (VAT), electronic money transfer levy (EMT), and exchange difference, Manga said the federal government received N735.08 billion, states received N660.34 billion, and local governments got N485.03 billion.

Also, the oil producing states received N120.35 billion as derivation, (13 percent of mineral revenue).

FAAC said N152.68 billion was given for the cost of collection, while N1.68 trillion was allocated for transfers, intervention and refunds.

The communique also indicated that the gross revenue available from the VAT for the month of July 2025 was N687.94 billion as against N678.16 billion in June, representing an increase of N9.77 billion.

“From that amount, the sum of N27.51 billion was allocated for the cost of collection and the sum of N19.81 billion given for Transfers, Intervention and Refunds,” the statement reads.

“The remaining sum of N640.61 billion was distributed to the three tiers of government, of which the federal government got N96.09 billion, the States received N320.305 Billion and local government Councils got N224.21 billion.”

FAAC said gross statutory revenue of N3.07 trillion received for the month was lower than the N3.48 trillion received in the previous month by N415.10 billion .

From the stated amount, the sum of N123.59 billion was allocated for the cost of collection and N1.66 trillion for transfers, intervention and refunds.

“The remaining balance of N1.28 trillion was distributed as follows to the three tiers of government: Federal Government got the sum of N613.805 Billion, States received N311.330 Billion, the sum of N240.023 Billion was allocated to LGCs and N117.714 Billion was given to Derivation Revenue (13% Mineral producing States),” FAAC said.

For EMTL, the committe said out of N39.16 billion, the federal government received N5.64 billion, states got N18.80 billion, local governments received N13.16 billion, while N1.56 billion was allocated for cost of collection.

The Communique added that out of N39.74 billion from exchange difference, the federal government got N19.54 billion, states received N9.91 billion, the LGAs got N7.64 billion, while the oil producing states received N2.64 billion.

In addition, FAAC said petroleum profit tax (PPT), excise duty, electronic money transfer levy (EMTL), and oil and royalties increased significantly, while VAT and import duty increased marginally.

The committee added that company income tax (CIT) and CET levies decreased.

According to the communique, the total revenue distributable for July 2025, was drawn from statutory revenue of N1.28 trillion, VAT of N640.61 billion, N37.60 billion from EMTL, and N39.74 billion from exchange difference, bringing the total distributable amount for the month to N2 trillion.

Advertisement

In his opening remarks during the meeting, Edun, commended the FAAC committee for their diligent efforts in ensuring the effective allocation of resources to the various tiers of government.

The minister noted that the economic reforms embarked upon by the federal government are yielding positive results and the collective efforts will continue to drive growth and development.

Business

The unending meter conundrum

The federal government has implemented several initiatives aimed at ensuring adequacy in electricity metering. These efforts have however proved to be almost ineffective even as the metering gap in the country remains at seven million. Stakeholders in the industry have since called for the liberalisation of meters sales and purchase as a way around the conundrum. Last week, the Power Minister appeared to have stirred the hornet’s nest declaring that meters under DISREP be issued and installed free of charge to consumers. The fallout has caused bickering between the DISCOS, consumers and other stakeholders- threatening over the installation of 1.5 million meters.

The Power Minister, Adebayo Adelabu, may have been a self-effacing man during his time at the Central Bank of Nigeria (CBN). However, owing to the quantum of demands and expectations of the ministry he superintends presently, the Adelabu has had to shout himself to the rooftops.

While the minister may have unwittingly been vocal, stakeholders are convinced that it may be as a result of the need to succeed by delivering power to the Nigerian public, especially at a time when patience seem to be running out.

His latest outburst on metering is one that obviously touches the raw nerves of electricity consumers as well as the utilities.

“I want to mention that it is unprecedented that these meters are to be installed and distributed to consumers free of charge—free of charge! Nobody should collect money from any consumer. It is an illegality. It is an offence for the officials of distribution companies across Nigeria to request a dime before installation; even the indirect installers cannot ask consumers for a dime. It has to be installed free of charge so that billings and collections will improve for the sector,” an elated Adelabu said last week during an on-site inspection of newly imported smart meters at APM Terminals, Apapa, Lagos.

But the statement by the Minister exposed a brewing tension in the sector, leading to divergent tunes from all stakeholders in the electricity value chain, placing the Distribution Companies (DisCos) and the Federal Government at logger heads over who pays for the cost of the meters and installation.

The metering schemes

The issue of meters in the sector remains very touchy given that efforts at ensuring adequately metering of electricity consumers have at best not yielded the desired result. To date, Nigeria has an estimated shortfall of seven million meters- a situation that has both placed a huge revenue loss on the electricity value chain as well as the consumers who are slammed bith bogus estimated billings.

There are various metering schemes initiatives by the federal government aimed at reducing the seven million metering gap in the country. These include Meter Asset Provider (MAP), as enshrined in 2018/2019 via a NERC regulation allowing third-party investors to supply and install meters. Customers under this scheme pay upfront for meters and are refunded through energy tokens over time. MAPs are companies granted approval by NERC to procure and install meters for customers of DisCos. Customers are required to make an upfront payment for the meter and the cost recovered over a period of time approved by the NERC.

In 2020, the National Mass Metering Programme (NMMP), a Federal Government initiative funded by the CBN to provide free meters to Nigerians, aiming to end estimated billing, was introduced. This intervention sought to increase metering rate, eliminate arbitrary estimated billing, strengthen the local meter manufacturing sector, job creation and reduction of collections losses. Under this scheme, meters are provided and installed at no upfront cost to the consumer.

A seed capital of ₦200 billion was invested to facilitate the Nigeria Electricity Supply Industry (NESI) revenue collections through the programme. Under Phase-0 of the NMMP, the sum of ₦59.280 billion was set aside for financing the installation of one million meters.

From inception to date, 89.96 per cent of the funds allocated for NMMP under phase 0 has been disbursed to 11 DisCos for procurement of 962,832 meters through 23 Meter Asset Providers.

The funding under Phase 0 is through the CBN/NESI; financing for the phase 1, with a procurement of 1.5 million meter units, is through the CBN/ DMBs (Deposit Money Banks), while financing for the Phase 2, with a four million meter units procurement, is from the World Bank.

Still is the Presidential Metering Initiative (PMI), established in 2023, as a five-year, 10-million-meter initiative, supported by the Nigeria Sovereign Investment Authority (NSIA) and World Bank, designed to fast-track metering. This initiative aims to close the metering gap for 60 per cent of estimated-billing customers by 2027 through the deployment of over five million smart meters to be funded by the Meter Acquisition Fund (MAF) and Federation-funded initiatives. The Meter Acquisition Fund (MAF) Tranche B, guaranteed NERC-approved funds of ₦28 billion for Discos to provide free meters specifically for Band A and B customers.

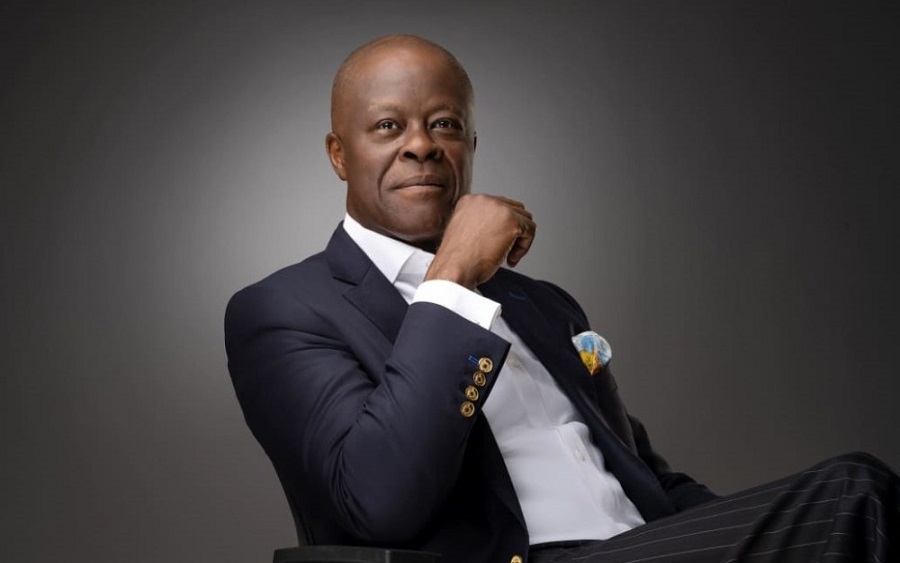

Dr. Joy Ogaji

Funding for meters under MAF is built from a pool of contributions from all 12 DisCos based on their market collections. It gives priority in tiers- with the current phase (Tranche B) focusing on completing the metering of all outstanding Band A customers before fully extending to Band B. DisCos must use these funds to procure meters through competitive bidding and complete installations by specific deadlines.

Also is the Distribution Sector Recovery Program (DISREP), a $500 million World Bank-funded initiative to deliver 3.4 million smart meters for free to consumers. It also aims to improve the financial and technical performance of the country’s electricity distribution companies (DisCos). Like the NMMP and MAP Schemes, DisCos are expected to repay the cost of these meters over a period of ten-years. DisCos are also responsible for distribution, installation and maintenance of these meters within their franchise states.

A far older metering scheme was the Credited Advance Payment for Metering Implementation (CAPMI), introduced by the NERC in 2013. The CAPMI allowed electricity customers to pay for their own meters to speed up installation and avoid estimated billing. Customers, who paid for meters directly were to be refunded through energy credits over a set period. The scheme was wound down in 2016 after it was found that only about 500,000 meters were deployed between 2013 and 2016, with many DisCos failing to fulfill their obligations despite receiving funds.

How free are meters?

Adelabu’s free meter installation directed that prepaid meters procured under the World Bank–funded DISREP, has elicited mixed reactions. While the government argued that electricity consumers will only pay for the ongoing free meter installation through deductions from their electricity tokens, the DisCos are concerned over the long period of recovery of such funds which spans over a period of 10 years. They argue that such arrangement has effects on their operations, especially cost recovery, installation expenses and the financial implications.

The position of government is understandable given that suppliers, it claimed, have already been fully paid for both the meters and the installation. Therefore, the reasoning is that Discos charging consumers again for installation would not only slow down the meter uptake, but it will also undermine the goal of the initiative.

The Minister’s team pointed to poor enumeration and inaccurate customer information as the main bottlenecks, disclosing that installers are often sent to wrong addresses or to premises that are not technically ready for metering. The Director-General, Bureau of Public Enterprises (BPE), Ayo Gbeleyi, takes the Discos’ position with a pinch of salt. Gbeleyi, who was in attendance at the N501billion bond issuance signing ceremony to settle legacy debts in the power sector, regretted that the god gesture of government in line with free metering was being antagonised by the utilities.

He maintained that claims of repayment over 10 years assertions were inaccurate and misleading, explaining that cost of meters, transformer, feeders, and other components of investments, are embedded in tariffs and recouped over time.

“We’ve had pushback. The truth is, every component of investment that goes into the DisCos gets recouped through the tariff structure. So, whether it is a feeder pillar, whether it is a transformer, or whether it is a meter, we as consumers will ultimately pay for those pieces of equipment through the tariff design,” the BPE boss clarified.

He explained further: “What they (Discos) are not telling you is that the Federal Government’s major intervention is indeed one of the best loan transactions today extended to the power sector. It is a 20-year loan facility. It comes with a five-year principal moratorium and a two-year interest moratorium to the DisCos. We have never seen any capital lending to that sector of that magnitude in the history of the power sector in Nigeria.”

A public sector analyst, Mayowa Sodipo, corroborated the position of Gbeleyi, insisting that at no point in time was meter allocation ever free of charge. For him, the while Adelabu may have played to the gallery with his statement knowing that these meters and installation costs have been factored into the electricity tariff paid by the consumer, he may have equally saved the consumers from exploitation.

“At no point was meter ever free to any consumer. You pay through your electricity purchase because it is deducted from your token over a period of time. So the Discos are not the ones even paying for the meters as they are now trying to claim, but the consumers because the cost is deducted from their electricity tariff bought. So the Discos are not paying but the consumers are paying for the meters,” Sodipo argued.

But the Discos are worried that as a business concern, the burden on payment for meters still rests with them. An official of a South West Disco who spoke on condition of anonymity depriving payment for installation is an extra burden on the Discos because this segment is contracted out to installers, who are not on the pay roll of the Discos.

“So if consumers are not paying for installation, who should? Is the minster saying that the Discos should still carrying the financial implication of this?” the official asked rhetorically.

In a submission on the development, a Kano state based social commentator, Dr. Abubakar Ibrahim, for Nigeria to close its metering gap, there is need for collaborative policy implementation between the regulators, government authorities, Discos and meter providers and installers.

“They must all agree to work together to establish a clear and sustainable funding framework that covers both meter procurement and installation. The federal government on its part must design a financial framework that will balance customers’ interest with the sector financial sustainability,” Dr. Ibrahim said.

He further said that while the federal government’s objectives is clearly to close the metering gap and ensure fair billing, however, lack of alignment with DisCos could unintentionally delay the very benefits the policy seeks to deliver.

The Executive Director, Emmanuel Egbigah Foundation, Prof Wunmi Iledare, submission in in sync with Dr. Ibrahim’s. He insisted that the development is a symptom of deeper structural and governance failures in the power sector. He said it is appalling for the Federal Government, as a part-owner of the DisCos, to publicly complain about their conduct without addressing underlying regulatory lapses, leaves more to be desired.

Way to go

Dr. Ibrahim and Prof. Iledare’s submissions summarises a critical issue in the metering scheme. Key industry stakeholders in the value chain blamed the Discos shows of apathy of Discos towards meter installation on the fact that they have not been part of the procurement process including the selection of installaters.

“For this DISREP, the federal government nominated the installers, at a low cost expecting DisCos to cover some part of the cost to mobilise the installation activities. As usual since DisCos are not part of the entire procurement and acquisition process unlike other metering mechanisms, then they will show apathy; DisCos always wanted to have a say in some of these projects.

“On paper the paper the meters are free but the last mile issues are cost burdens that the DisCos are not willing to cover. This is why the process is slow and bulk of the facilities are in stores across the DisCos,” a very senior official of a Disco, who asked to be anonymous owing to the sensitivity of the matter, revealed at the weekend.

With a recurring situation, the Managing Director / CEO/ Executive Secretary, Association of Power Generation Companies (APGC), Dr. Joy Ogaji, advocates that metering should be liberalized. To this end, Ogaji argued, both government and Discos should hands off meter matters and allow it to run like the mobile phone is run in the telecommunications sector so that consumers can freely go to the open market to buy meters.

Although she agreed that when customers buy meters from shops instead of DisCos, revenue assurance can become challenging, she nonetheless said this can be addressed through meter registration with DisCos to track usage and ownership; standardistion, by mandating the use of approved, tamper-evident meters with remote monitoring capabilities; implementing a centralised vending systems for meter top-ups, linking purchases to customer accounts and collaboration with shops and regulators to ensure compliance with industry standards, insisting that this approach helps DisCos track revenue and reduce losses

“Design the standard or specifications for the meters for various categories- 1-phase, 3phase etc; make it available in shops for anyone to purchase; train installers and only contact your Discos to inform them of synchronization. With this, no cunnundrum; everyone is happy, except there are ulterior motives,” Ogaji submitted, warning that if after 15 years of privatization of the sector, metering still remains a problem, then there is no point continuing with is the way it is being done.

Energy

‘Blame regulators for contract delays despite President Tinubu’s order’, says PETAN

The Chairman, Petroleum Technology Association of Nigeria (PETAN), Wole Ogunsanya, has blamed petroleum industry regulators for persistent delays in oil and gas contracting processes, despite a presidential directive requiring tenders to be concluded within six months. Ogunsanya disclosed this during his presentation at the opening ceremony of the Nigeria International Energy Summit (NIES) 2026 in Abuja, yesterday. The Presidential directive is aimed at accelerating project execution across the energy sector.

Recall that President Tinubu in March 2024, issued Executive Order (OE) 42 mandating reduction of petroleum sector contracting costs and timelines, being part of a wider set of oil and gas reforms signed by the administration.

“We are not concluding contract processes in six months as directed and reports sent to the Presidency often fail to reflect the realities faced by industry players,” the PETAN boss said.

Ogunsanya disclosed that his Association is currently monitoring ongoing tenders, emphasising that several projects scheduled to commence in 2026 and 2027 remain stalled due to prolonged contracting cycles.

He noted that execution gaps persist despite a significant increase in contracting activities involving expressions of interest, tenders, pre-qualifications, and technical and commercial evaluations since the fourth quarter of 2024. He also identified prolonged internal approvals, delayed Final Investment Decisions (FIDs), slow commercial negotiations, extended regulatory and compliance procedures, and funding and financial close challenges as major bottlenecks undermining project delivery.

According to him, a study conducted by PETAN revealed that the current rate of contract awards falls significantly short of the Presidential benchmark of completing tenders within six months, with most contracts structured for five years and a possible two-year renewal.

Ogunsanya therefore called on the Presidency to give closer monitoring of the contracting process to ensure that awards and project execution align with presidential timelines, warning that continued delays could weaken investor confidence and slow sector growth.

Fed. govt’s ₦501 billion power sector Bond records 100% subscription

• Stakeholders hail President Tinubu on initiative

• Programme to stimulate economy

The Federal Government has successfully issued a ₦501 billion inaugural bond under the Presidential Power Sector Debt Reduction Programme (PPSDRP), recording 100 per cent subscription from pension funds, banks, asset managers and other investors. It also marked a significant step towards resolving legacy debts, restoring liquidity and strengthening confidence in the Nigerian Electricity Supply Industry (NESI).

The initiative is designed to address long-standing payment arrears owed to power generation companies, which for over a decade constrained liquidity, weakened balance sheets and discouraged investment across the power sector value chain.

The signing follows the successful completion of Series 1 Power Sector Bond Issuance by Nigeria Bulk Electricity Trading (NBET) Finance Company Plc. Series 1 issuance closed at ₦501 billion, comprising ₦300 billion raised from the capital markets and ₦201 billion in bonds allotted to participating power generation companies, reflecting strong investor confidence in the reform agenda.

Under the Programme, verified receivables for electricity supplied between February 2015 and March 2025 are being settled through negotiated agreements with power generation companies. To date, five power generation companies representing 14 power plants nationwide: First Independent Power Limited (FIPL); Geregu Power Plc; Ibom Power Company Limited; Mabon Limited and Niger Delta Power Holding Company Limited (NDPHC)- have executed Settlement Agreements with NBET. The total negotiated settlement amount for these companies stands at ₦827.16 billion, to be paid in four phased instalments.

Proceeds from Series 1 issuance will fund the first and second instalment payments to participating power generation companies with signed Settlement Agreements, estimated at ₦421.42 billion, representing approximately 50 per cent of the total negotiated settlement amount. The payment for this initial phase will be made through a mix of cash and notes.

When completed, the programme will impact 4,483.60MWh/h of electricity generation capacity by GenCos, effectively finalising settlement of payments for 290,644.84GWhr of electricity billed since February 2015 and providing a strong foundation for new investments into capacity enhancement and expansion by companies serving 12.03mn active registered customers across the country.

Speaking at the bond issuance signing ceremony which held at the Grand African Ballroom, Lagos Continental Hotel, Victoria Island, Lagos, the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, said the ceremony marks a critical turning point in the collective efforts to address long-standing structural challenges in Nigeria’s power sector and to lay a stronger foundation for its long-term sustainability.

Edun, who was represented by the Director-General, Debt Management Office, Patience Oniha, explained that for many years, legacy debts owed to Generation Companies (GenCos) have constrained liquidity across the electricity value chain, weakening balance sheets, discouraged investment and ultimately limited the sector’s ability to deliver reliable power to Nigerian homes and businesses.

According to the Minister, the Federal Government recognised that resolving these legacy issues was not optional but essential, giving rise to the Presidential Power Sector Debt Reduction Programme (PPSDRP) and subsequently to the ₦4 trillion Power Sector Multi-Instrument Issuance Programme, designed as a structured, credible, and fiscally responsible mechanism for settling these obligations.

“This transaction sends a clear and reassuring signal to the power sector and to the wider economy that the Federal Government is committed to honouring its obligations. We are prepared to deploy innovative financial solutions to resolve systemic challenges and we remain focused on restoring liquidity, confidence, and discipline across the electricity market. By settling legacy debts in a structured manner, we are enabling Generation Companies to stabilise operations, improve maintenance and attract new investment- all of which are critical to improving power supply nationwide,” Edun said.

He disclosed that the programme is anchored on strong governance, transparency and fiscal prudence. The Ministry of Finance, working closely with NBET and other stakeholders, remains committed to ensuring that this initiative supports sector reform while safeguarding macroeconomic stability.

Edun was emphatic that a sustainable power sector is not just an energy objective, but an economic imperative because reliable electricity underpins industrial growth, job creation, and improved quality of life for millions of Nigerians.

In similar vein, the Special Adviser to the President on Energy, Olu Arowolo Verheijen, stated that the programme represents a decisive reset of the electricity market, combining debt resolution with broader financial and structural reforms.

She noted that the country’s electricity sector has been constrained not by lack of demand or installed capacity, but by unresolved legacy liabilities and chronic liquidity shortfalls. Those pressures, she argued, weakened balance sheets across the value chain, constrained gas supply, reduced plant availability and ultimately limited the pace at which electricity could be delivered reliably to homes and businesses.

Aware of this, Verheijen said the President Bola Tinubu administration conviction of having a viable power sector led to the establishment of the Presidential Power Sector Debt Reduction Programme, chaired by the Minister of Finance/Coordinating Minister of the Economy and technically led by her office.

“This Programme was not conceived as a bailout. It is a balance-sheet reset. Its purpose is straightforward: to clear verified legacy obligations, restore liquidity, and re-establish the conditions under which operators can plan, operate, and invest on commercial terms. Over the past several months, we have worked closely with the Ministry of Finance, NBET, NERC, and power generation companies to reconcile claims and negotiate settlements based strictly on verified obligations. Today’s signing marks the outcome of that process.

“Fourteen generation companies have executed Full and Final Settlement Agreements, with a total negotiated value of approximately ₦827 billion. These agreements reflect discipline, compromise, and a shared commitment to closing the chapter on legacy arrears,” Verheijen said.

Therefore, she said, resolving these liabilities restores liquidity across the value chain, strengthens payment certainty for gas suppliers and creates the financial headroom required for operators to stabilise assets, improve availability and plan new investment.

Also speaking at the signing ceremony, the NBET Managing Director, Johnson Akinnawo, described the programme as a historic and defining moment for Nigeria’s power sector.

“This historic programme received the resolute approval of President Bola Tinubu and the Federal Executive Council. Mr. President’s decisive endorsement is not just a procedural step; it is the bedrock of this ambition. It signals the highest level of commitment to the total revitalisation of our nation’s power sector,” Akinnawo said, adding that the development would strengthen market disciplines while enabling growth across generation and the other segments of the electricity value chain.

Akinnawo stressed the broader significance of reliable electricity for national development, saying, “Reliable electricity is not just an enabler of economic activity. It is the backbone of national development, social advancement and global competitiveness.”

The Group Managing Director, Sahara Power Group, Kola Adesina, who’s conglomerate owns five power plants, said: “Capital formation can only come when there is confidence, when you can truly see a line of sight in recovering investments previously made. Because we were being owed so much, it was a bit of a problem for us to put in more money. But last year we took the bull by the horns, based on President Bola Ahmed Tinubu’s commitment in resolving the legacy issues and I can say that once this process is over, construction will commence immediately on the second phase of our Egbin Power Plant. On behalf of the Generation Companies, I’d like to thank the President for this resolution.”

By clearing historic arrears, the programme is expected to improve liquidity for power generation companies, strengthen their ability to meet operating and debt obligations, unlock new investment across the sector and support more reliable electricity supply to homes and businesses. It also reinforces fiscal discipline through validated claims, negotiated settlements and transparent capital market financing.

CardinalStone Partners Limited, an Investment banking firm, led the consortium of appointed professional parties as Lead Financial Adviser and Lead Issuing House to successfully execute the Series 1 Bond Issue, working closely with NBET that acted as Sponsor on the Transaction, and the Office of the Special Adviser on Energy that led the settlement negotiations and engagements with the Generation Companies.

-

Art & Life9 years ago

Art & Life9 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Business9 years ago

Business9 years agoThe 9 worst mistakes you can ever make at work

-

Art & Life9 years ago

Art & Life9 years agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 years ago

Entertainment9 years agoThe old and New Edition cast comes together to perform

-

Sports9 years ago

Sports9 years agoPhillies’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment9 years ago

Entertainment9 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Entertainment9 years ago

Entertainment9 years agoDisney’s live-action Aladdin finally finds its stars