Energy

Crude oil production shrinks in September

• Yearly growth rises 1.6%

• NUPRC blames PENGASSAN strike

After rallying to steady production increase, one that bolstered the country’s hope of improved increased revenue from sales of the commodity, crude oil and condensates production for the month of September 2025 fell to an average of 1.581 million barrels per day, according to official statistics released by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) yesterday.

The 1.581 million barrels per day average production in September comprises of 1.39 million bopd of crude oil and 191,373 bopd of condensate.

The NUPRC, in a statement by its Head of Media and Strategic Communication, Eniola Akinkuotu, blamed the fall on the three-day industrial action by the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), which resulted in the shutdown of some production and export facilities.

Besides, the NUPRC also noted that two strategic facilities had a scheduled turnaround maintenance which led to a reduction in overall production.

Recall that PENGASSAN had called out its members on an industrial action over the sack of 800 workers by the management of the Dangote Petroleum Refinery and Petrochemicals who had joined its association.

According to its official statistics, in September, the industry recorded total crude oil and condensate production of 47.43 million barrels, reflecting a modest 1.61 per cent year-on-year increase in average daily crude oil and condensate production year on year. This represented a slight improvement over the 1.55 million bopd recorded in the same month of 2024, an uptick that suggests incremental progress.

However, when measured on a month-on-month basis, crude oil and condensate production slightly dropped by 3.09 per cent in September 2025, compared to the 1.63 million bopd recorded in August 2025. But despite the glitches experienced during the period, average crude oil production in September stood at 93 per cent of the country’s Organisation of Petroleum Exporting Countries (OPEC) quota of 1.5 million bopd.

During the review month, peak combined crude oil and condensate production hit 1.81 million bopd, while the lowest was 1.35 million bopd.

An analysis of production output by the country’s top eight streams shows that Forcados Blend accounted for 15.86 per cent of total production, while Bonny Light accounted for 13.31 per cent of September production. Qua Iboe was third accounting for 9.88 per cent; Escravos Light contributed 8.96 per cent, while Bonga Crude delivered 6.83 per cent of production in the review month.

Others were Agbami condensate which accounted for 4.94 per cent; Erha crude, which accounted for 4.55 per cent, while Amenam Blend accounted for 4.2 per cent to wrap up the production for the month in review.

Energy

Why stable power supply may remain elusive

• Over 60% of power plants unavailable for transmission in Q3 2025, says report

• Report exposes Discos culpability

• NERC may sanction erring entities

The state of electricity supply in the country has become a source of concern for residents. After enjoying a relative supply for some parts of last year, especially in the second quarter, drawing applause from consumers, the euphoria that greeted this has gradually becoming worrisome.

These concerns were more pronounced during the last yuletide, when several homes were left in the dark. The situation, electricity Distribution Companies (DisCos) often explain, results from national grid collapses, low power generation, gas supply shortages, or maintenance work by the Transmission Company of Nigeria (TCN). These issues, alongside infrastructure decay and vandalism, invariably leads to load shedding and intermittent supply.

Top officials of some Discos spoken to who pleaded for anonymity attributed power failures to a mix of upstream generation deficits, national grid instability and localised infrastructure challenges.

For a long time, there has been several horse-trading associated across the value chain over erratic power supply. For instance, it is common for DisCos often cite “system-wide disturbances” or “grid collapses” from the National Control Centre (NCC) as the reason for total outages across their franchise areas. Besides, many outages are blamed on “gas limitations” at thermal power plants and a general drop in power generation. This is because when generation drops, the energy allocated to DisCos decreases, forcing them to implement load shedding.

In situations like this, most hide under the guise of the feeder banding system. Under this framework, priority is given to “Band A” feeders, which are mandated to receive 20+ hours of supply thereby often leaving lower bands with significant outages when total available power is low.

Yet, is the technical faults and maintenance of equipment, equipment vandalism like destruction of transformers and theft of cables; planned maintenance, like upgrading or repairing transmission lines, are also factor readily given as excuses by service providers.

After enjoying relative stability in national grid in 2025, the facility experienced a first major collapse at the weekend caused by the simultaneous tripping of multiple 330kV transmission lines.

With this incident coming early in the year, stakeholders are worried that it may not be a good omen for the sector notwithstanding the several assurances by government. In 2024, 12 grid collapses were recorded; 12 in 2025 and one already recorded this year.

More worrisome is that the epileptic power supply has remained irrespective of the fiscal appropriation to the sector under the President Bola Tinubu administration.

A cursory look at these allocation indicate that in the last three years, there has been a consistent increase in fiscal allocation to the Ministry of Power aimed at resolving the underlying issues that have consistently impeded growth in the sector, including the consistent grid collapses each year.

A breakdown of the figures the three years showed that the power ministry got a cumulative allocation of N239.5 billion in 2023; N344.097 billion in 2024; N2.1 trillion in the 2025 budget, a clear indication of the priority placed on the sector by the current administration.

A further breakdown of the figures show that the power sector recovery programme received N810 billion from the budget; special intervention project got N269.74 billion, while the presidential power initiative (PPI) transmission project received N150 billion, all in an attempt to tackle the enormous challenges in the nation’s power sector from specific and targeted approach.

The Minister of Power, Adebayo Adelabu, assured that the ministry has set the agenda for Nigeria’s power sector in the year 2026, suggesting that the country has done enough to stabilise its grid in the previous year.

But these challenges appear unresolved despite huge budgetary allocations to the power sector. Giving more insight into what may be the cause of the deep-seated challenges confronting the country’s electricity supply is a recent report by the Nigerian Electricity Regulatory Commission (NERC) for the third quarter of 2025. The report, released recently, indicated that over 60 per cent of power plants installed generation capacity in the country remained unavailable for transmission to the national grid in the third quarter of 2025.

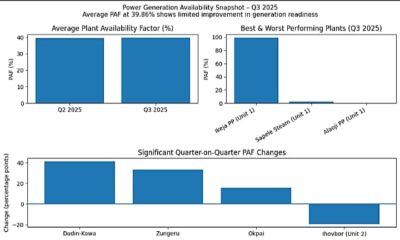

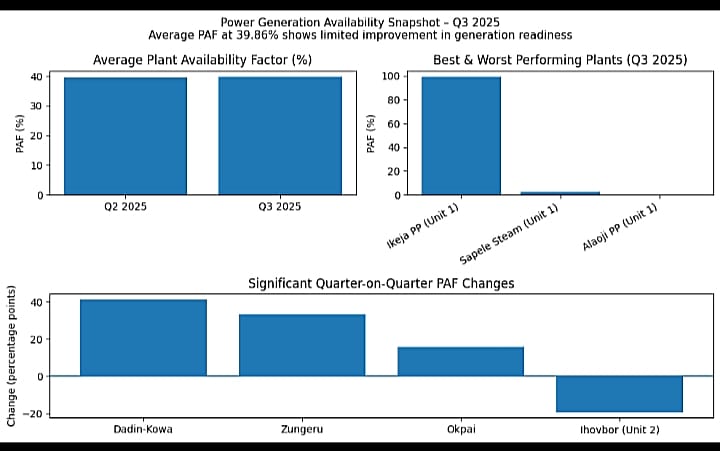

According to the NERC report, the average Plant Availability Factor (PAF) of all 28 grid-connected power plants stood at 39.86 per cent, meaning that 60.14 per cent of installed capacity could not be dispatched to the national grid at any point during the quarter. The figure represents only a 0.26 percentage-point increase from the 39.60 per cent recorded in Q2 2025, highlighting how limited progress has been in improving the operational readiness of generation assets.

“In 2025/Q3, the average plant availability factor for all grid-connected plants was 39.86 per cent, that is, at any point in time during the quarter, 60.14 per cent of the installed capacity across the 28 grid-connected power plants was not available for dispatch onto the grid,” the report read.

The PAF measures the ratio of a power plant’s declared available capacity to its manufacturer-rated installed capacity and is widely regarded by regulators as a key indicator of the health of the upstream segment of the Nigerian Electricity Supply Industry (NESI).

It further noted that while 11 power plants recorded availability above 50 per cent, Ikeja Power Plant (Unit 1) emerged as the best-performing asset, posting a PAF of 99.24 per cent during the quarter. At the lower end, Sapele Steam Plant (Unit 1) recorded a PAF of just 2.66 per cent, while Alaoji Power Plant (Unit 1) failed to dispatch any electricity at all throughout the quarter.

Significantly quarter-on-quarter improvements were recorded at Dadin-Kowa (+41.32pp), Zungeru (+33.29pp) and Okpai (+15.95pp), reflecting gains from improved hydrology and reduced outages.

However, availability declined sharply at Ihovbor (Unit 2), which fell by 19.21 percentage points to 78.16 per cent, down from 97.38 per cent in Q2. Other plants that recorded notable drops included Geregu (Unit 1), Ibom Power, and Geregu (Unit 2).

“Overall, 11 power plants had availability factors above 50 per cent, with Ikeja_1 power plant recording the highest availability factor at 99.24 per cent. On the other end of the spectrum, Sapele Steam_1 recorded a PAF of 2.66 per cent in 2025/Q3. Alaoji_1 power plant was not available to dispatch any energy onto the grid throughout the quarter.

“Significant increases in PAF were recorded in Dadin-Kowa_1 (+41.32pp), Zungeru_1 (+33.29pp), and Okpai_1 (+15.95pp) power plants across the two quarters. Conversely, the PAF of Ihovbor_2 decreased significantly by 19.21pp during the quarter (78.16 per cent in 2025/Q3 compared to 97.38 per cent in 2025/Q2). Reductions in PAF were also recorded in Geregu_1 (- 12.79pp), Ibom power_1 (-10.34pp), and Geregu_2 (-8.41pp) power plants,” the NERC report said.

The commission attributed the fluctuations in plant availability to mechanical outages, feedstock constraints, hydrological conditions and operational limitations, factors that have continued to undermine Nigeria’s generation capacity for over a decade.

Beyond generation challenges, the report also highlighted weak energy offtake by electricity Discos, raising concerns over revenue recovery and market discipline. Under the Partial Activation of Contract regime, which came into force in July 2022, DisCos are required to off-take and pay for their Partially Contracted Capacity on a take-or-pay basis, even if they fail to utilise the power.

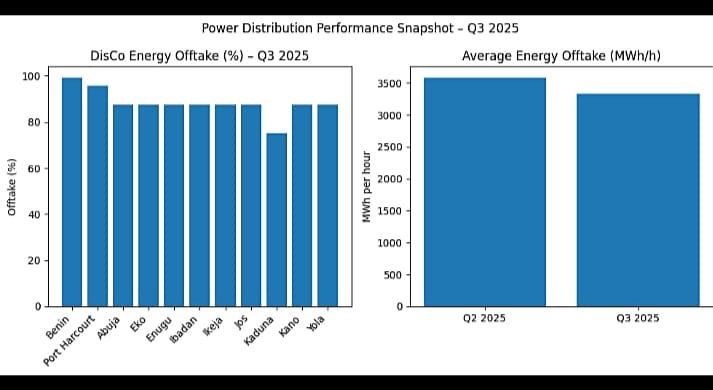

In Q3 2025, average energy offtake by DisCos fell to 3,328.33 megawatt-hours per hour, representing a 7.10 per cent decline from 3,582.62MWh/h recorded in the preceding quarter.

This decline occurred despite the fact that available contracted capacity dropped by only 2.43 per cent, suggesting that generation and transmission availability were sufficient to sustain previous offtake levels.

Overall, cumulative DisCo energy offtake performance during the quarter stood at 87.39 per cent, down from 91.78 per cent in Q2, a 4.39 percentage-point decline.

“All DisCos except Jos recorded a decline in their energy offtake performance during the quarter,” the report noted.

The commission attributed the reduced offtake to a combination of infrastructure weaknesses, seasonal demand changes and commercial considerations.

It noted that frequent network outages during the rainy season, driven by fragile distribution infrastructure, limited the ability of DisCos to evacuate power to customers.

In addition, cooler weather conditions reduced domestic electricity demand, while some DisCos deliberately constrained supply to loss-prone feeders to minimise financial exposure.

Under the Performance Monitoring Framework Orders issued in July 2024, DisCos are required to off-take at least 95 per cent of their available PCC or face regulatory sanctions.

However, in Q3 2025, only Benin and Port Harcourt DisCos met the threshold, with offtake levels of 99.20 per cent and 95.65 per cent, respectively.

The remaining nine DisCos, Abuja, Eko, Enugu, Ibadan, Ikeja, Jos, Kaduna, Kano and Yola, fell short, with Kaduna DisCo recording the lowest performance at 75.23 per cent.

“The Commission has commenced the implementation of appropriate sanctions against defaulting DisCos,” the report stated.

The figures reflect the persistent mismatch between installed capacity, available generation, and effective electricity delivery, a challenge that continues to frustrate households and businesses.

Despite Nigeria’s installed generation capacity exceeding 13,000 megawatts, average operational availability and weak offtake mean that actual electricity delivered to consumers remains far below demand, reinforcing dependence on self-generation and driving up energy costs.

Energy

BREAKING: Dangote Refinery increases ex gantry petrol price to N799/ litre

Dangote Petroleum Refinery and Petrochemicals has announced an increase in the ex gantry price of premium motor spirit (PMS) or petrol. The Refinery raised the product price from N699 per litre to N799 per litre. Its partner retail outlet- MRS, will sell at N839 per litre.

The firm also reaffirmed its commitment to market stability and uninterrupted nationwide supply of petrol.

Dangote Refinery, in a statement obtained late last night, explained that the facility implemented a deliberate and temporary price support intervention during the festive period to cushion the effect of heightened household spending during the yuletide on Nigerians..

“This marked the second consecutive festive season in which the Refinery absorbed significant costs in the national interest, including logistics support in 2024 and a price reduction in 2025 to promote affordability and market calm.

“Despite the price reduction, many filling stations failed to reflect the new price at the pump, thereby denying Nigerians the benefits of the reduction,” it added.

It added that with the festive period over, PMS prices, it said, have been modestly realigned to sustainable levels to support long term market stability and affordability.

The Chief Executive Officer, Dangote Petroleum Refinery, David Bird, stated that the Refinery continues to supply the domestic market with approximately 50 million litres of PMS daily, with nationwide evacuation and distribution operating normally.

He noted that the Refinery’s design flexibility allows it to process a wide range of crude and intermediate feedstocks, enabling continued PMS supply during planned maintenance activities. According to him, this capability ensures that domestic supply remains stable and uninterrupted.

He noted that the Refinery’s design flexibility allows it to process a wide range of crude and intermediate feedstocks, enabling continued PMS supply during planned maintenance activities. He added that this capability ensures that domestic supply remains stable and uninterrupted.

“As a domestic producer, Dangote Petroleum Refinery continues to shield the Nigerian market from import related volatility and external supply disruptions, while remaining a stabilising force in the downstream petroleum sector. Dangote Petroleum Refinery remains focused on delivering energy security, price stability, and long-term value for Nigerians,” the statement said.

Energy

Fed Govt takes delivery of 500, 000 smart meters

· Don’t pay for installation, Minister tells Nigerians

The federal government yesterday took delivery of about 500,000 smart meters as a further decisive step towards ending the metering gap across the country. The meters, coming under the World Bank funded Distribution Sector Recovery Programme (DISREP), is supporting the government to import a total of about 3.4 million meters in two batches.

The first batch consists of 1.43 million meters, out of which about a million meters has been received. Currently, almost 150,000 meters have already been installed across customers, across all distribution companies in the four corners of the country.

The delivery yesterday is also an initiative to further compliment the Presidential Metering Initiative (PMI), which has a target of procuring about 10 million meters over the next five years, at an average of two million meters in a year.

Expectedly, with the synergy between the DISREP, the PMI, the Meter Acquisition Fund (MAF) and the MAP will translate into the desired result of completely eliminating the seven million current metering gap in the country.

The Minister of Power, Adebayo Adelabu, while inspecting and taking delivery of the imported meters at the APM Terminal, Apapa, was emphatic that the meters are to be installed free of charge.

“I also want to mention that it is also unprecedented that these meters are to be installed and distributed to consumers free of charge, free of charge! Nobody should collect money from any consumer. It is an illegality. Is an offence for the officials of Distribution Companies (DisCos) across Nigeria to request for a dime before installation, even the indirect installers cannot ask the consumers for a dime. It has to be installed free of charge, so that Billings and collections will improve for the sector,” Adelabu warned.

According to the Minister, with the delivery, the journey of completely eliminating the meter gap in the Nigerian power sector has just begun. He expressed optimism that in a couple of years from now, every household, business, institution, industry, will be fully metered, to ensure that billing and revenue collections in the power sector will become more transparent, very fair and will be very just, including improving the readiness of electricity consumers to pay their bills.

Highlighting the benefits of adequate metering of consumers, Adelabu contended that it will lead to improved liquidity in the sector.

“When you have improved liquidity in the sector, the sectoral revenue will be able to pay a higher percentage of the energy cost in the industry, which will eventually lead to improvement in efficiency, improvement in effectiveness of operations, and we will be able to achieve the much awaited stability, reliability and functionality of electric supply to our household, our businesses, our institutions and to our industries.

“This will aid and accelerate our economic growth and industrial development, it will also improve the prosperity of our people, create more jobs, more productivity and revenues will be on the increase and ultimately, improve the standard of living of our people, while unemployment rates will be on the increase,” the Minister explained.

He further revealed that yesterday’s milestone represented the first time in the country will be simultaneously importing and buying locally this volume of meters- all to ensure that the power sector is completely transformed.

The Director General of the Bureau of Public Enterprises (BPE), Ayo Gbeleyi, assured that a new order prescribing the protocol and the processes that DisCos must follow in order to ensure that consumers have an unhindered access to meter installations and also that will address the concern that DisCos are delaying meter installations will soon be released by the Nigerian electricity Regulatory Commission (NERC).

“We have our dashboard, we have our trackers and all stakeholders’ hands on deck to ensure seamless and rapid deployment of these meters. The meters you are seeing here are actually manufactured to the specific requirement of each DisCo. They are also inscribed on the meter; there’s also an anti-theft protocol embedded in it. The configuration is to a particular DisCo, so you can’t take a meter configured for Eko DisCo and go and install it in Ibadan,” Gbeleyi said.

In similar vein, the Chairman, Mojec, Mojisola Abdul, explained that the meters supplied by the Federal government is to genuinely generate more revenue for the country to be able to supply more power.

“Physically, we have installed almost close to 150,000 meters and they are free. Don’t give anybody money. You are not allowed. We had meeting Wednesday with the minister, and as well as the DG BPE about the further progress of how to make it easy for every Nigerians. And we are going to call it mobile registration of meter free. That means you register today, under three days, your meter is installed,” She said.

Clarifying the delay in meter installations after months of application and payments made, the minister said: “In the past, we have never seen this volume of meter availability. So it was possible then that there was a rationalisation of the few that you have on the ground, and at that time you are also required to pay for it. But this one is from two perspectives. Number one, the volume is there. We have received over almost one million and more are still coming in the first phase.

“In the second phase, another 1.55 million meters are coming. And again, it has to be installed free of charge for the consumers, so the issue of the complications you have expressed in the past would be completely eliminated. What you are seeing today is not the first set of deliveries; we’ve been receiving this in the past couple of months and they have been taken to their various destination in the discord territories, and we have installed almost 150, 000 meters,” Adelabu concluded.

-

Art & Life9 years ago

Art & Life9 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Business9 years ago

Business9 years agoThe 9 worst mistakes you can ever make at work

-

Art & Life9 years ago

Art & Life9 years agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 years ago

Entertainment9 years agoThe old and New Edition cast comes together to perform

-

Sports9 years ago

Sports9 years agoPhillies’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment9 years ago

Entertainment9 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Entertainment9 years ago

Entertainment9 years agoDisney’s live-action Aladdin finally finds its stars