Energy

NUPRC records 16 high impact achievements post-PIA

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has said it has achieved 16 high impact feats since its establishment four years ago despite the legacy challenges it inherited from the pre-Petroleum Industry Act era.

According to a statement signed by the Commission’s Head, Media and Strategic Communication, Eniola Akinkuotu, in 2022, 2023 and 2024, the NUPRC surpassed its revenue target by 18.3 per cent, 14.65 per cent and 84.2 per cent respectively despite fluctuations in oil production and prices thus contributing largely to the country’s economic growth.

Still, it noted that between 2024 and 2025, it approved 79 Field Development Plans (FDP), that is, 41 in 2024 and 38 YTD 2025, with potential investment of $39.98 billion, made up of $20.55b in 2024 and $19.43b in YTD 2025.

NUPRC further said since its inception, crude oil production has increased with current average daily production of 1.65Mbopd expected to increase further with the Project 1Mbopd initiative which is aimed at achieving 2.5 Mbopd in 2027 compared to NUPRC commencement.

“Prior to the establishment of the Commission, the licensing rounds were opaque. They were beclouded by political influence which made the process lack credibility. However, the NUPRC with the support of President Bola Tinubu, transformed the process to be fully digital thereby enhancing transparency and credibility. It was the most transparent bid round on record in Nigeria’s upstream petroleum history as it leveraged digital technology, devoid of any human interference, in a manner adjudged to be in line with global best practices which was even attested to by the Nigeria Extractive Industries Transparency Initiative (NEITI),” the Commission said in a statement.

In line with the PIA 2021, implementing the ‘Drill or Drop’ policy which prescribes that unexplored acreages are to be relinquished, has also been implemented. The policy is designed to ensure the optimal use of oil assets and prevent dormant fields from tying up potential reserves. This policy successfully identified 400 dormant oil fields and has also propelled complacent oil companies to take quick action.

It noted further that the rig count in the upstream oil and gas sector, rose geometrically from eight in 2021 to 69 as of October 2, 2025. The latest rig count of 69 which comprises 40 active rigs, eight on standby, five on warm stack, four on cold stack and 12 on the move, represents a 762.5 per cent increase in barely four years. The number is expected to increase even further in the coming months. This shows a renewed investor confidence in Nigeria and that the right investment climate prevails now in the Nigeria upstream as daily actioned by the NUPRC.

The Commission approved divestments running into billions of dollars in 2024. From the Nigeria Agip Oil Company (NAOC) to Oando Energy Resources; Equinor to Chappal Energies; Mobil Producing Nigeria Unlimited to Seplat Energies; and Shell Development Company Nigeria Limited to Renaissance Africa Energy. The divestment is about investor portfolio re-ordering to focus on deep-offshore development.

To give meaning to the intent of the PIA, 2021, the Commission in consultation with stakeholders has developed 24 regulations. So far 19 have been gazetted while five await gazetting. These forward-thinking Regulations serve as tools for transparency and creation of enabling investment climate and benchmark best practices

In gas flaring commercialization efforts, the commission completed awards of flare sites to successful bidders under the Nigerian Gas Flare Commercialisation Programme (NGFCP). The programme is aimed at eliminating gas flaring and attracting at least $2.5 billion in investments.

Still, the Host Community Development Trusts have remitted N122.34b and over $168.91m as of October 2025. This translates to a combined remittance of over N358.67b based on the prevalent exchange rate in enthroning a conducive host community environment in Nigeria. The Commission is also overseeing at least 536 projects at various stages of completion including schools, health centers, roads and vocational centers being funded by the trust fund.

It is worthy of mention that as part of its mandate to develop the country’s hydrocarbon, the Commission has recorded 306 development wells drilled and completed between 2022 to date. It has also removed hindrances to exploration with 2D and 3D Seismic Data with the issuance of Nigeria’s first Petroleum Exploration Licence (PEL) for a large offshore geophysical survey covering 56,000 km² of 3D seismic and gravity data.

Furthermore, the Commission has reprocessed 17,000 line-kilometres of 2D seismic data and 28,000 square kilometres of 3D seismic data, producing sharper, higher-resolution images of the country’s petroleum systems thereby reducing the uncertainties that once hindered exploration decisions.

Other data acquisition includes: 11,300 Sq.km of newly acquired 3D data, processed to PSDM and 80,000 Sq.km of Multibeam Echo Sounding & Seafloor Geochemical Coring data.

In 2021, the average daily crude oil losses stood at 102,900 barrels per day or 37.6 million barrels per year. However, due to combined efforts of the General Security Forces and Private Security Contractors (TANTITA) as well as collaborative effort of the Commission this has reduced by 90 per cent to specifically 9,600bpd in September 2025. Furthermore, two pioneer regulations introduced by the Commission have also contributed to the success, namely: The Upstream Measurement Regulation and the Advanced Cargo Declaration Regulation respectively, have contributed as pioneer efforts at achieving transparency in hydrocarbon accounting.

Even outside the shores of Nigeria, the engineer Gbenga Komolafe-led NUPRC has continued to show leadership as it championed the establishment of the African Petroleum Regulators Forum (AFRIPERF). AFRIPERF provides regulators with the mechanism to harmonise oil and gas development policies to facilitate cross-border infrastructure development, benchmark fiscals and present strong voice for Africa in hydrocarbon advocacy globally.

Energy

‘Blame regulators for contract delays despite President Tinubu’s order’, says PETAN

The Chairman, Petroleum Technology Association of Nigeria (PETAN), Wole Ogunsanya, has blamed petroleum industry regulators for persistent delays in oil and gas contracting processes, despite a presidential directive requiring tenders to be concluded within six months. Ogunsanya disclosed this during his presentation at the opening ceremony of the Nigeria International Energy Summit (NIES) 2026 in Abuja, yesterday. The Presidential directive is aimed at accelerating project execution across the energy sector.

Recall that President Tinubu in March 2024, issued Executive Order (OE) 42 mandating reduction of petroleum sector contracting costs and timelines, being part of a wider set of oil and gas reforms signed by the administration.

“We are not concluding contract processes in six months as directed and reports sent to the Presidency often fail to reflect the realities faced by industry players,” the PETAN boss said.

Ogunsanya disclosed that his Association is currently monitoring ongoing tenders, emphasising that several projects scheduled to commence in 2026 and 2027 remain stalled due to prolonged contracting cycles.

He noted that execution gaps persist despite a significant increase in contracting activities involving expressions of interest, tenders, pre-qualifications, and technical and commercial evaluations since the fourth quarter of 2024. He also identified prolonged internal approvals, delayed Final Investment Decisions (FIDs), slow commercial negotiations, extended regulatory and compliance procedures, and funding and financial close challenges as major bottlenecks undermining project delivery.

According to him, a study conducted by PETAN revealed that the current rate of contract awards falls significantly short of the Presidential benchmark of completing tenders within six months, with most contracts structured for five years and a possible two-year renewal.

Ogunsanya therefore called on the Presidency to give closer monitoring of the contracting process to ensure that awards and project execution align with presidential timelines, warning that continued delays could weaken investor confidence and slow sector growth.

Energy

Fed govt’s policies secured over $8b FIDs in oil, gas industry, says President Tinubu

• Domestic gas supply exceeded 2 billion cubic feet daily

• NNPC to expand Escravos Lagos Pipeline Line

President Bola Tinubu has said his administration has strengthened the oil and gas sector to secure a Final Investment Decisions (FIDs) surpassing $8 billion in offshore gas developments from global energy firms.

He said the torrent of direct investments into the sector revived strongly because of regulatory certainty and fiscal reforms.

President Tinubu disclosed this yesterday while officially declaring open the 9th edition of the Nigeria International Energy Summit (NIES) at the Banquet Hall, State House, in Abuja. He was represented by Vice President, Kashim Shettima.

President Tinubu said: “The sector secured final investment decisions exceeding $8 billion, including major offshore gas developments involving global energy companies. The outpouring of direct investment into the oil and gas sector rebounded strongly, driven by regulatory certainty, fiscal reforms and improved operational guidelines and conditions.”

He said domestic gas supply exceeded two billion cubic feet per day for the first time, strengthening power generation, industrial utilisation and energy access. Export volumes, according to him, increased alongside sustained expansion of gas processing and transportation infrastructure, reinforcing Nigeria’s role in regional and global gas markets.

The President reminded the stakeholders that on his assumption of office in 2023, the sector was only rich in potential, but weighed down by inefficiencies, uncertainty and underinvestment.

His words: “When this administration assumed the mantle of leadership in May 2023, we inherited an energy sector rich in potential, yet constrained by inefficiencies, uncertainty, and prolonged underinvestment. We set to work without panicking, guided by the clear understanding that energy cannot be treated simply as an economic commodity if stability is our goal. Energy is a catalyst for national security, industrial growth, social inclusion, and regional cooperation.”

Tinubu said under his administration, Nigeria’s upstream activity recorded a historic rebound, recounts growth from eight weeks in 2021 to 69 weeks by late 2025, reflecting renewed exploration and building momentum

The Federal Government, he said, has also introduced a broad executive order on oil and gas investment enabling to unlock up to $10 billion in capital inflows, streamline project approvals, reduce bureaucratic delays and position Nigeria as a prepared investment destination.

He recalled that in 2025, the administration introduced the Upstream Petroleum Operations Cost Efficiency Incentives Order, providing tax credits of up to 20 per cent to promote cost efficiency, enhanced competitiveness, and deepened Nigerian participation.

Tinubu also noted that as a direct result of the reforms the government has introduced, Nigeria’s average crude oil production improved to approximately 1.6 million barrels per day.

The administration, he said, consolidated its role as a live wire of sector reform and strengthened regulatory institutions to ensure clarity of goals, transparency and investor competitiveness.

He added that the country introduced fully digital, transparent, and competitive licensing rounds to the upstream sector, widely regarded as among the most credible bidding processes in our history.

On the 2025 bid round, he said: “In furtherance of this objective, we approved the commencement of the 2025 licensing round, creating new investment windows and enabling additional crude oil and gas production capacity.”

He said Nigeria’s refining landscape entered a new era with the commencement of local operations and the Dangote Petroleum Refinery, significantly enhancing domestic supply of refined petroleum products.

The President said modular and indigenous refineries advanced under supportive regulatory frameworks, diversifying national refining capacity. On the Nigerian National Petroleum Company Limited NNPCL refineries, he said “Rehabilitation of state-owned refineries also gained renewed momentum, with operational stability and efficiency remaining a primary focus.”

He added that the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) recorded strong and consistent revenue performance, surpassing annual targets and fiscal sustainability.

In similar vein, the Minister of State for Petroleum Resources (Oil), Senator Heineken Lokpobiri said the renewed confidence has culminated in the huge FIDs inflows into the sector.

He said: “International confidence has also returned: Shell’s $5 billion Bonga North project, and TotalEnergies’ $550 million Ubeta project marks Nigeria’s first major FIDs in over a decade. This was followed by Shell’s $2 billion HI project and the $1.8m cumulative spent by Chevron in their Panther project.

“Only recently, the global CEO of Shell announced their commitment to taking a $20 billion FID, with several other FID lined up to be announced in this year and in the coming year.

“In 2025 alone, 28 new field development plans worth $18.2 billion were signed, with potentials of 1.4 billion barrels of oil daily.

Between 2024 and 2025, of the seven major FIDs announced across Africa, four were in Nigeria. This did not happen by accident, it is the result of steady work, policy clarity, and better governance. These are not rhetorics but proof that Nigeria is once again a magnet for serious business.”

In his remarks, the Nigerian National Petroleum Company Limited (NNPCL) Group Chief Executive (Officer) Bashir Ojulari, an engineer, revealed that the firm has planned to expand the Escravos Lagos Pipeline Line (ESPL) this year.

Hear him: “Our recent achievements reflect this momentum. The presentation of the NNPC Gas Master Plan last week and the remarkable progress of our strategic gas infrastructure projects, the OB3 and the AKK pipeline and we are moving forward this year to also expand the ELPS pipeline, and the regional pipelines to their projects signal a new era of mining discipline, infrastructure development, and long-term commitments. These projects are more than a pipeline.”

NNPCL, according to him, is nurturing a new generation of professionals grounded in accountability, performance excellence and national service.

He said the strategic shifts, under the leadership of President Tinubu, is positioning Nigeria in a global competitive investment destination, from fiscal stability to policy liberalisation and security improvement.

Energy

Why stable power supply may remain elusive

• Over 60% of power plants unavailable for transmission in Q3 2025, says report

• Report exposes Discos culpability

• NERC may sanction erring entities

The state of electricity supply in the country has become a source of concern for residents. After enjoying a relative supply for some parts of last year, especially in the second quarter, drawing applause from consumers, the euphoria that greeted this has gradually becoming worrisome.

These concerns were more pronounced during the last yuletide, when several homes were left in the dark. The situation, electricity Distribution Companies (DisCos) often explain, results from national grid collapses, low power generation, gas supply shortages, or maintenance work by the Transmission Company of Nigeria (TCN). These issues, alongside infrastructure decay and vandalism, invariably leads to load shedding and intermittent supply.

Top officials of some Discos spoken to who pleaded for anonymity attributed power failures to a mix of upstream generation deficits, national grid instability and localised infrastructure challenges.

For a long time, there has been several horse-trading associated across the value chain over erratic power supply. For instance, it is common for DisCos often cite “system-wide disturbances” or “grid collapses” from the National Control Centre (NCC) as the reason for total outages across their franchise areas. Besides, many outages are blamed on “gas limitations” at thermal power plants and a general drop in power generation. This is because when generation drops, the energy allocated to DisCos decreases, forcing them to implement load shedding.

In situations like this, most hide under the guise of the feeder banding system. Under this framework, priority is given to “Band A” feeders, which are mandated to receive 20+ hours of supply thereby often leaving lower bands with significant outages when total available power is low.

Yet, is the technical faults and maintenance of equipment, equipment vandalism like destruction of transformers and theft of cables; planned maintenance, like upgrading or repairing transmission lines, are also factor readily given as excuses by service providers.

After enjoying relative stability in national grid in 2025, the facility experienced a first major collapse at the weekend caused by the simultaneous tripping of multiple 330kV transmission lines.

With this incident coming early in the year, stakeholders are worried that it may not be a good omen for the sector notwithstanding the several assurances by government. In 2024, 12 grid collapses were recorded; 12 in 2025 and one already recorded this year.

More worrisome is that the epileptic power supply has remained irrespective of the fiscal appropriation to the sector under the President Bola Tinubu administration.

A cursory look at these allocation indicate that in the last three years, there has been a consistent increase in fiscal allocation to the Ministry of Power aimed at resolving the underlying issues that have consistently impeded growth in the sector, including the consistent grid collapses each year.

A breakdown of the figures the three years showed that the power ministry got a cumulative allocation of N239.5 billion in 2023; N344.097 billion in 2024; N2.1 trillion in the 2025 budget, a clear indication of the priority placed on the sector by the current administration.

A further breakdown of the figures show that the power sector recovery programme received N810 billion from the budget; special intervention project got N269.74 billion, while the presidential power initiative (PPI) transmission project received N150 billion, all in an attempt to tackle the enormous challenges in the nation’s power sector from specific and targeted approach.

The Minister of Power, Adebayo Adelabu, assured that the ministry has set the agenda for Nigeria’s power sector in the year 2026, suggesting that the country has done enough to stabilise its grid in the previous year.

But these challenges appear unresolved despite huge budgetary allocations to the power sector. Giving more insight into what may be the cause of the deep-seated challenges confronting the country’s electricity supply is a recent report by the Nigerian Electricity Regulatory Commission (NERC) for the third quarter of 2025. The report, released recently, indicated that over 60 per cent of power plants installed generation capacity in the country remained unavailable for transmission to the national grid in the third quarter of 2025.

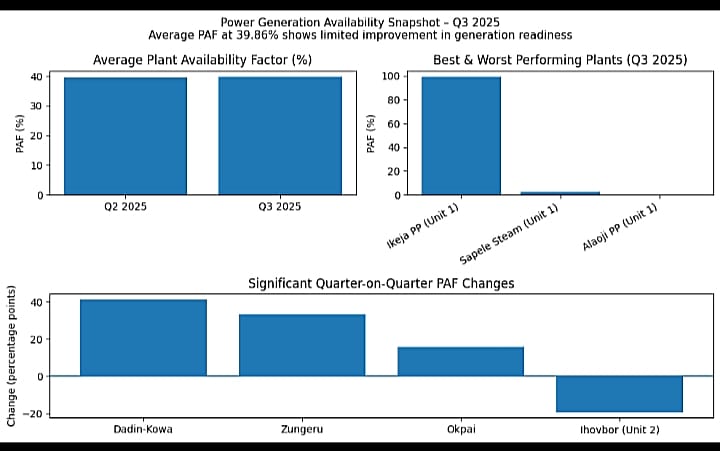

According to the NERC report, the average Plant Availability Factor (PAF) of all 28 grid-connected power plants stood at 39.86 per cent, meaning that 60.14 per cent of installed capacity could not be dispatched to the national grid at any point during the quarter. The figure represents only a 0.26 percentage-point increase from the 39.60 per cent recorded in Q2 2025, highlighting how limited progress has been in improving the operational readiness of generation assets.

“In 2025/Q3, the average plant availability factor for all grid-connected plants was 39.86 per cent, that is, at any point in time during the quarter, 60.14 per cent of the installed capacity across the 28 grid-connected power plants was not available for dispatch onto the grid,” the report read.

The PAF measures the ratio of a power plant’s declared available capacity to its manufacturer-rated installed capacity and is widely regarded by regulators as a key indicator of the health of the upstream segment of the Nigerian Electricity Supply Industry (NESI).

It further noted that while 11 power plants recorded availability above 50 per cent, Ikeja Power Plant (Unit 1) emerged as the best-performing asset, posting a PAF of 99.24 per cent during the quarter. At the lower end, Sapele Steam Plant (Unit 1) recorded a PAF of just 2.66 per cent, while Alaoji Power Plant (Unit 1) failed to dispatch any electricity at all throughout the quarter.

Significantly quarter-on-quarter improvements were recorded at Dadin-Kowa (+41.32pp), Zungeru (+33.29pp) and Okpai (+15.95pp), reflecting gains from improved hydrology and reduced outages.

However, availability declined sharply at Ihovbor (Unit 2), which fell by 19.21 percentage points to 78.16 per cent, down from 97.38 per cent in Q2. Other plants that recorded notable drops included Geregu (Unit 1), Ibom Power, and Geregu (Unit 2).

“Overall, 11 power plants had availability factors above 50 per cent, with Ikeja_1 power plant recording the highest availability factor at 99.24 per cent. On the other end of the spectrum, Sapele Steam_1 recorded a PAF of 2.66 per cent in 2025/Q3. Alaoji_1 power plant was not available to dispatch any energy onto the grid throughout the quarter.

“Significant increases in PAF were recorded in Dadin-Kowa_1 (+41.32pp), Zungeru_1 (+33.29pp), and Okpai_1 (+15.95pp) power plants across the two quarters. Conversely, the PAF of Ihovbor_2 decreased significantly by 19.21pp during the quarter (78.16 per cent in 2025/Q3 compared to 97.38 per cent in 2025/Q2). Reductions in PAF were also recorded in Geregu_1 (- 12.79pp), Ibom power_1 (-10.34pp), and Geregu_2 (-8.41pp) power plants,” the NERC report said.

The commission attributed the fluctuations in plant availability to mechanical outages, feedstock constraints, hydrological conditions and operational limitations, factors that have continued to undermine Nigeria’s generation capacity for over a decade.

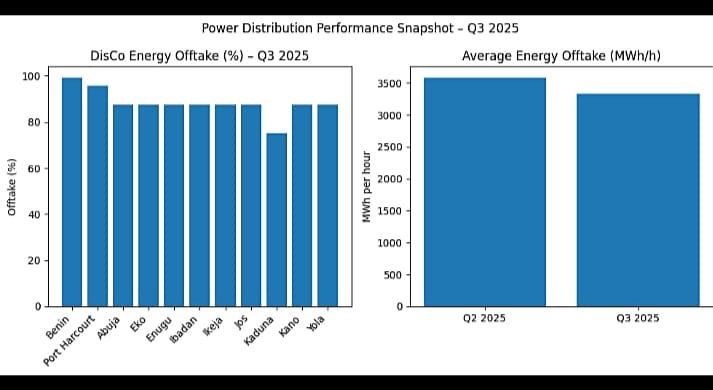

Beyond generation challenges, the report also highlighted weak energy offtake by electricity Discos, raising concerns over revenue recovery and market discipline. Under the Partial Activation of Contract regime, which came into force in July 2022, DisCos are required to off-take and pay for their Partially Contracted Capacity on a take-or-pay basis, even if they fail to utilise the power.

In Q3 2025, average energy offtake by DisCos fell to 3,328.33 megawatt-hours per hour, representing a 7.10 per cent decline from 3,582.62MWh/h recorded in the preceding quarter.

This decline occurred despite the fact that available contracted capacity dropped by only 2.43 per cent, suggesting that generation and transmission availability were sufficient to sustain previous offtake levels.

Overall, cumulative DisCo energy offtake performance during the quarter stood at 87.39 per cent, down from 91.78 per cent in Q2, a 4.39 percentage-point decline.

“All DisCos except Jos recorded a decline in their energy offtake performance during the quarter,” the report noted.

The commission attributed the reduced offtake to a combination of infrastructure weaknesses, seasonal demand changes and commercial considerations.

It noted that frequent network outages during the rainy season, driven by fragile distribution infrastructure, limited the ability of DisCos to evacuate power to customers.

In addition, cooler weather conditions reduced domestic electricity demand, while some DisCos deliberately constrained supply to loss-prone feeders to minimise financial exposure.

Under the Performance Monitoring Framework Orders issued in July 2024, DisCos are required to off-take at least 95 per cent of their available PCC or face regulatory sanctions.

However, in Q3 2025, only Benin and Port Harcourt DisCos met the threshold, with offtake levels of 99.20 per cent and 95.65 per cent, respectively.

The remaining nine DisCos, Abuja, Eko, Enugu, Ibadan, Ikeja, Jos, Kaduna, Kano and Yola, fell short, with Kaduna DisCo recording the lowest performance at 75.23 per cent.

“The Commission has commenced the implementation of appropriate sanctions against defaulting DisCos,” the report stated.

The figures reflect the persistent mismatch between installed capacity, available generation, and effective electricity delivery, a challenge that continues to frustrate households and businesses.

Despite Nigeria’s installed generation capacity exceeding 13,000 megawatts, average operational availability and weak offtake mean that actual electricity delivered to consumers remains far below demand, reinforcing dependence on self-generation and driving up energy costs.

-

Art & Life9 years ago

Art & Life9 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Business9 years ago

Business9 years agoThe 9 worst mistakes you can ever make at work

-

Art & Life9 years ago

Art & Life9 years agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 years ago

Entertainment9 years agoThe old and New Edition cast comes together to perform

-

Sports9 years ago

Sports9 years agoPhillies’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment9 years ago

Entertainment9 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Entertainment9 years ago

Entertainment9 years agoDisney’s live-action Aladdin finally finds its stars